Coty Announces Strategic Partnership with KKR; Reports 3Q Fiscal Results

SHARE WITH :

Financial IMAGES

- Coty to receive immediate $750 million convertible preferred equity investment from KKR

- Coty and KKR sign a Memorandum of Understanding for KKR to acquire a majority stake in Coty’s Professional Beauty and Retail Hair Businesses; Transaction could result in additional cash proceeds of approximately $3 billion

- Coty reports 3Q fiscal results with revenues in line with previous market guidance and announces plans to reduce fixed costs by $700 million

NEW YORK - May 11, 2020 -- Coty Inc. (NYSE: COTY) (“Coty” or the “Company”) today announced a strategic partnership with global investment firm KKR which will provide the Company with an initial investment of $750 million through the sale of convertible preferred shares to KKR. Additionally, Coty and KKR signed a Memorandum of Understanding (“MOU”) for the sale of a majority in Coty’s Professional Beauty and Retail Hair Businesses including the Wella, Clairol, OPI and ghd brands (together, “Wella”) at a contemplated enterprise value of $4.3 billion, or 12.3x 2019 EBITDA. Coty also announced its financial results for the third quarter of fiscal year 2020, ended March 31, 2020, including comprehensive plans to reduce fixed costs by $700 million.

Under the terms of the MOU, Coty will carve out Wella into a standalone company in which KKR will acquire a 60 percent stake and Coty will retain the remaining 40 percent interest. The contemplated majority divestment of Wella would result in Coty receiving additional cash proceeds of approximately $3 billion. On signing of the Wella transaction,, KKR will also make an incremental convertible preferred investment of $250 million in Coty. Together with the initial $750 million investment, these transactions will result in significant deleveraging of Coty’s balance sheet and position the company for long-term growth and investment in its core portfolio. Coty’s mass beauty business in Brazil will remain a fully owned business of Coty.

Peter Harf, Founding Partner of JAB and Chairman of Coty, commented: “We are thrilled to enter into this strategic partnership with KKR, one of the world’s preeminent investment firms with an exemplary track record of value creation. Their investment and partnership will be instrumental to strengthening Coty’s balance sheet and helping the company to achieve long-term growth in shareholder value.”

Johannes Huth, Partner and Head of KKR EMEA, said: “Coty is a leader in the attractive global beauty market with iconic brands, global presence and scale, and a strong track record of innovation and growth. We are excited to form this partnership to invest in Coty to support it through this period of unprecedented global uncertainty and allow it to emerge as a stronger, more agile business, and to acquire a majority stake in Wella, a market leader with a strong portfolio of brands in the attractive professional hair market where we see significant opportunities to accelerate growth in partnership with its experienced leadership team. We look forward to working towards the establishment of a lasting and value-creating strategic partnership.”

Pierre-André Terisse, Coty COO and CFO added: “Today’s announcement with KKR provides an increased sense of energy and excitement for all of us at Coty. As part of a number of steps to continue Coty’s transformation, the strategic partnership with KKR is clearly the most game-changing. We will see immediate improvement to our balance sheet and are in the final stages of finalizing a 60/40 partnership for our Professional Beauty and Retail Hair businesses. In the shadow of a global lockdown, we have also announced a comprehensive plan to reduce fixed costs by $700 million, which allows us to confirm our target to reach mid teens operating margins by FY23. Overall, this alliance and the steps we are taking to strengthen our businesses will be key elements of our transformation.”

Strategic Transaction with KKR

Effective immediately, Coty has agreed to issue $750 million of convertible preference shares and KKR is fully subscribing to the issue. These shares will carry a coupon of 9% and will be convertible into Coty shares at $6.24, equating to a 20% premium to Coty’s closing stock price on May 8, 2020 of $5.20. KKR will be entitled to two seats on Coty’s Board of Directors following the completion of the transaction.

Simultaneously, Coty and KKR have signed an MOU and are engaged in exclusive talks to form a partnership for Wella at an enterprise value of $4.3 billion, in which KKR is expected to own 60 percent and Coty 40 percent, subject only to completion of limited confirmatory due diligence and execution of definitive documentation. Upon signing of the Wella transaction, Coty will issue $250 million of additional convertible preference shares to KKR with the same coupon and strike price provisions as the first $750 million tranche, resulting in incremental total proceeds of $3.3 billion. KKR is making its investment primarily from its flagship North American and European private equity funds, Americas Fund XII and European Fund V.

AFW LP, Credit Suisse, and Vicente & Partners are serving as financial advisors to Coty, and Skadden, Arps, Slate, Meagher & Flom LLP are serving as legal counsel to Coty.

Medium Term Outlook

Assuming the successful completion of the KKR partnership, Coty’s expanded $700 million fixed cost reduction program will make the Company more competitive. Coty continues to target operating margins in the mid-teens by FY23.

Financial Results

Highlights:

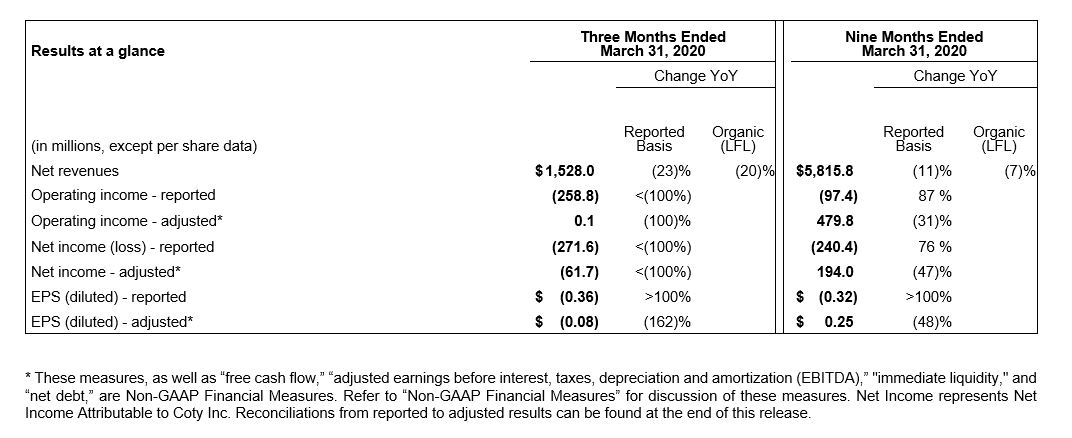

- 3Q20 net revenue decreased 23.2%, with 19.5% organic LFL decline, in-line with recent update

- 3Q20 adjusted operating income was $0.1 million, weighed down by significant operating deleverage, with an adjusted EPS of $(0.08)

- Strong immediate liquidity position of $1.3 billion in cash on hand

- Secured holiday on leverage covenant for next 4 quarters, with no change in funding costs

- Comprehensive plan to reduce fixed cost by $700 million (approximately 25% of the current fixed cost base) over the next 30 months by amplifying the turnaround plan across the organization, including supply chain and controllable fixed costs, with over 2/3 of the savings incremental to the original turnaround plan

Revenues:

- 3Q20 reported net revenues of $1,528.0 million decreased 23.2% year-over-year, including a negative foreign exchange (FX) impact of 2.3%. Like-for-like (LFL) revenue decreased 19.5%. The LFL performance was driven by LFL declines in the Asia Pacific segment of 34.8%, EMEA of 20.1%, Americas of 18.8%, and Professional Beauty of 11.9%.

- While Asia Pacific performance weakness began at the start of the quarter, driven by pressure in China and Asia Travel Retail, deterioration in the performance of the remaining segments began over the course of March in conjunction with the global lockdowns, resulting in LFL declines in the month of March of over 30%.

- Year-to-date reported net revenues of $5,815.8 million decreased by 11.0%, with a LFL revenue decline of 6.7%.

Gross Margin:

- 3Q20 reported gross margin of 59.6% decreased by 320 bps from the prior-year period, while the adjusted gross margin of 60.3% decreased by 260 bps, primarily due to the decline in sales volume related to COVID-19, increased excess and obsolescence expense, and underutilization expenses related to shutdown of certain manufacturing plants.

- Year-to-date reported gross margin of 61.9% increased 30 bps from the prior year, while the adjusted gross margin of 62.1% increased by 30 bps.

Operating Income:

- 3Q20 reported operating loss of $258.8 million decreased versus a 3Q19 reported operating income of $85.5 million, due to lower sales, reduced gross profit, as well as acquisition related expenses of $49.3 million, restructuring and other business realignment costs of $81.6 million, and impairment charges of $40.4 million, partially offset by lower A&CP expenses.

- 3Q20 adjusted operating income of $0.1 million declined from $229.5 million in the prior year. The adjusted operating margin of 0.0% decreased from 11.5% the prior-year period. This operating margin decline was driven by the lower gross margin, fixed cost deleverage, and the negative impact from transactional FX.

- Year-to-date reported operating loss of $97.4 million improved compared to reported operating loss of $739.8 million in the prior year due to an impairment charge of $977.7 million in the prior year. Year-to-date adjusted operating income of $479.8 million declined by 30.7% from the prior year, with a margin of 8.2%.

Net Income:

- 3Q20 reported net loss was $271.6 million compared to a reported net loss of $12.1 million in the prior-year period. The adjusted net loss of $61.7 million decreased from adjusted net income of $101.6 million in 3Q19, reflecting the breakeven adjusted operating income and $74 million of interest expense, partially offset by an adjusted tax benefit.

- Year-to-date reported net loss of $240.4 million improved from a reported net loss of $984.8 million in the prior-year, while the adjusted net income of $194.0 million decreased from $364.0 million in the prior year.

Earnings Per Share (EPS):

- 3Q20 reported loss per share was $0.36 compared to a reported loss per share of $0.02 in the prior year period. The adjusted loss per share of $0.08 decreased year-over-year due to the aforementioned decrease in adjusted net income.

- Year-to-date reported loss per share of $0.32 improved from a reported loss per share of $1.31 in the prior-year, and the adjusted EPS of $0.25 declined from $0.48 in the prior-year.

Operating Cash Flow:

- In 3Q20, net cash used in operating activities was $257.5 million, compared to net cash provided by operating activities of $213.7 million in the prior year period. The decline in operating cash flow was pressured by the significant profit decline on top of a seasonal weaker cash quarter, as well as the prior year impact of working capital management initiatives, particularly related to receivables factoring arrangements and timing of payables which have a lower incremental impact in the current year. Year-to-date operating cash flow totaled $204.5 million, down $246.9 million from the prior year period.

- Our 3Q20 free cash outflow of $318.9 million declined from a free cash inflow of $142.1 million in the prior year period, reflecting the operating cash flow decrease, partially offset by a $10.2 million decrease in capex. Year-to-date 3Q20 free cash outflow of $1.9 million decreased from an inflow of $120.5 million in the prior year.

Dividend and Net Debt:

- Net debt of $8,147.4 million on March 31, 2020 increased by $941.5 million from the balance of $7,205.9 million on December 31, 2019. The net debt increase was mainly driven by the payment, net of cash acquired, of $592.2 million for the Kylie Beauty transaction, the seasonal working capital needs, and dividend cash payment of $66.5 million.

- This resulted in a last twelve months Net debt to adjusted EBITDA ratio of 7.3x, an increase from the 5.3x reported ratio as of December 31, 2019. Coty's covenant leverage ratio at the end of Q3 was well below the permitted leverage level of 5.95x. Coty recently amended its credit agreement, including a waiver on leverage covenants for the next 4 quarters through 3QFY21.

- As Coty focuses on preserving cash in this critical time, the Company is suspending the dividend through April 1, 2021 or until such later date that it reaches a leverage ratio of 4x.

Third Quarter Fiscal 2020 Business Review by Segment

Americas

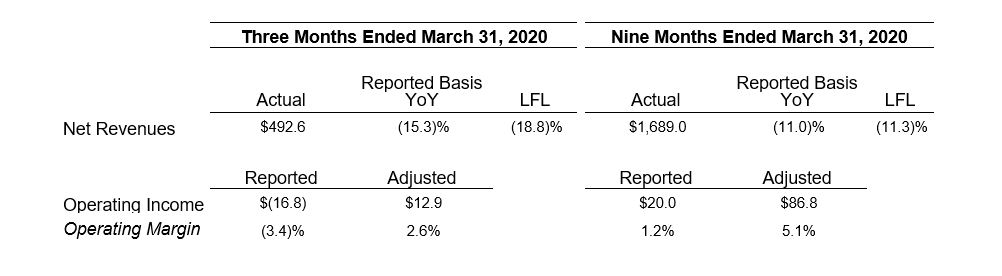

In 3Q20, reported Americas net revenues of $492.6 million decreased by 15.3% versus the prior year. On a LFL basis, Americas net revenues decreased by 18.8% primarily due to the outbreak of COVID-19 and related store closures.

For much of 3Q20, results were trending in line with our expectations, and we continued to make progress against our turnaround plan. The broad-based store closures and declining traffic in open retailers over the course of March significantly impacted results across all major markets, resulting in prestige brand sales declining over 30% and mass brands declining in the mid-teens. Against these store closures, part of the demand shifted to e-commerce channels, with very strong e-commerce growth in our mass and prestige brands.

Key operational progress amongst our mass beauty brands included a stabilization of CoverGirl's U.S. market share in brick & mortar supported by the success of the new Clean Fresh product line and growing Cover Girl market share on Amazon, as well as strong market share gains for Sally Hansen aided by core properties and the new good.kind.pure launch. In addition, our prestige brands maintained their strong share on- and off-line, with particularly strong performance for CK Everyone.

The reported sales for the Americas segment benefited from the first quarter of contribution from the Kylie Beauty partnership. The brand had solid sales and profit performance in the quarter, with particular strength in the Kylie Skin line.

The Americas segment reported an operating loss of $16.8 million compared to reported operating income of $36.4 million in the prior-year period. 3Q20 adjusted operating income was $12.9 million, down from $56.4 million in the prior year, driven by the lower sales and resultant operating deleverage. The 3Q20 adjusted operating margin was 2.6% versus 9.7% in 3Q19.

EMEA

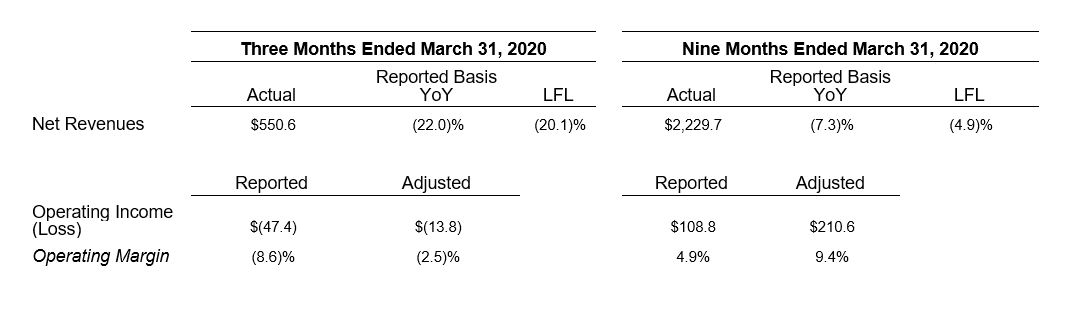

In 3Q20, reported EMEA net revenues of $550.6 million decreased by 22.0% versus the prior year. On a LFL basis, EMEA net revenues decreased 20.1%, which was largely due to the COVID-19 pandemic, as lockdowns commenced in Italy in February followed by most of Europe and the Middle East in March.

Our operational progress against our turnaround plan continued in the quarter, even as market conditions deteriorated. In our mass beauty business, we continued to gain market share with Rimmel in the U.K., as well as Max Factor, Bruno Banani and adidas in Germany. In our prestige business, the strong performance of recent launches Hugo Boss Alive and CK Everyone contributed to market share gains for our portfolio in the region.

Reported operating loss in 3Q20 was $47.4 million compared to reported operating income of $53.8 million in the prior year period. The 3Q20 adjusted operating loss of $13.8 million decreased from adjusted operating income of $88.3 million in the prior year period, driven by the lower sales and resultant operating deleverage. For 3Q20, the adjusted operating margin decreased to (2.5)% from 12.5% in the prior year.

Asia Pacific

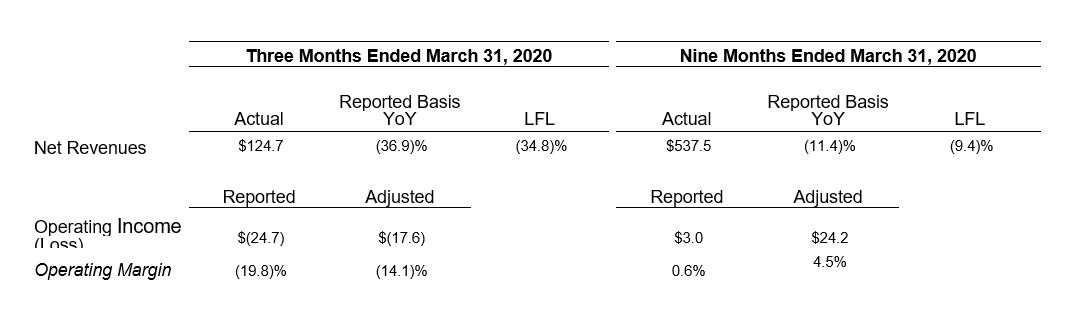

3Q20 Asia Pacific net revenues of $124.7 million decreased 36.9% on a reported basis and decreased 34.8% LFL. The decline was largely the result of the COVID-19 pandemic, which impacted the region, particularly China and surrounding Travel Retail, earlier than many other regions.

Since the lifting of the lockdowns in China, we have begun to see some improvement in the sales trends in China over the course of April, particularly in our Lancaster skincare brand, though the fragrance category remains pressured.

Reported operating loss in 3Q20 of $24.7 million declined from a reported operating income of $22.4 million in the prior year period. The 3Q20 adjusted operating loss of $17.6 million decreased from adjusted operating income of $29.2 million in the prior year period, fueled by the operating deleverage on the declining sales. The adjusted operating margin decreased to (14.1)% from 14.8% in the prior year.

Professional Beauty

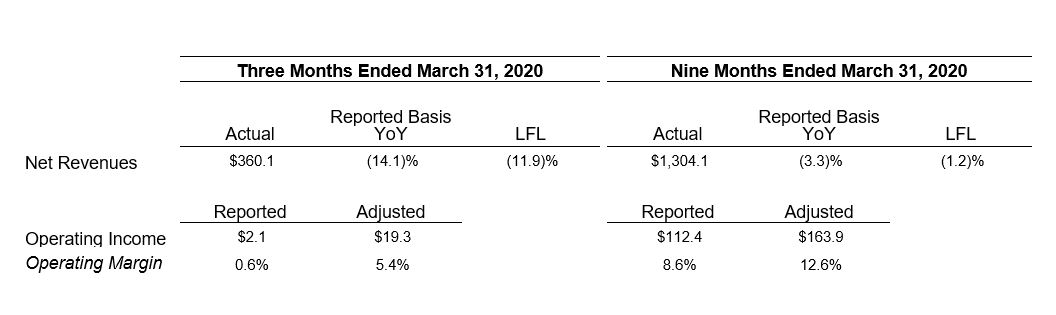

Professional Beauty 3Q20 reported net revenues of $360.1 million declined by 14.1%, with LFL decreasing 11.9%. These declines were due to the COVID-19 pandemic, which resulted in a significant amount of salon door closures over the course of March, which impacted the Hair and Nail product lines. At the same time, ghd continued to generate strong sales growth, benefiting from its strong e-commerce business. Across the full division, e-commerce sales continued to grow in the double digits, supported by our DTC platforms and e-retailers.

Professional Beauty reported operating income of $2.1 million decreased from $33.0 million in the prior year period, while adjusted operating income declined to $19.3 million from $49.7 million. The Professional Beauty division adjusted operating margin of 5.4% decreased 650 bps from prior period, as solid gross margin improvement was offset by the operating deleverage.

Third Quarter Fiscal 2020 Business Review by Channel

Luxury

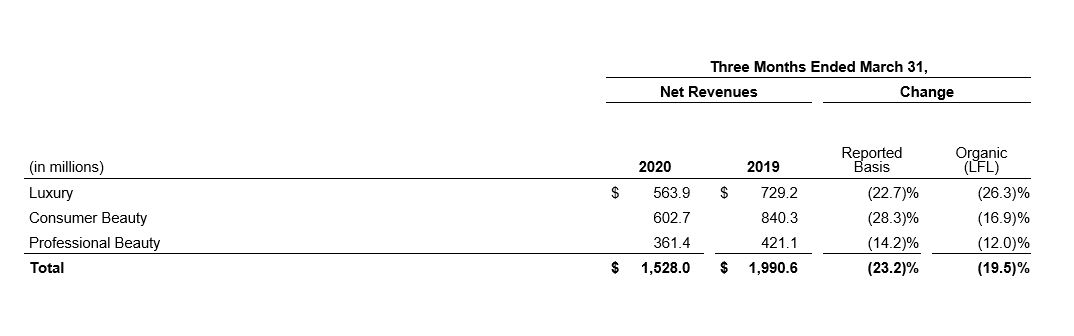

- Luxury net revenues of $563.9 million, or approximately 37% of total net revenues, declined 22.7% as reported and declined 26.3% LFL, with the reported sales decline aided by the inclusion of Kylie Beauty sales in the current quarter. Pressure earlier in the quarter in China and Travel Retail accelerated over the course of March, as globally department stores, perfumeries and specialty retailers closed their doors.

Consumer Beauty

- Consumer Beauty net revenues of $602.7 million, or approximately 39% of total net revenues, declined 28.3% as reported and declined 16.9% LFL, with the reported sales decline pressured by the inclusion of Younique revenues in the prior year period. Sales in this channel experienced increased pressure during March, as traffic to mass retailers and drugstores globally declined, and consumers shifted their purchasing to more essential personal care categories, resulting in underperformance for the color cosmetics category.

Professional Beauty

- Professional Beauty net revenues of $361.4 million, or approximately 24% of total net revenues, declined 14.2% as reported and declined 12.0% LFL, due to a significant amount of salon door closures over the course of March, which impacted the Hair and Nail product lines, partially offset by growth in ghd.

Other Company Developments

Other company developments include:

- On February 28, 2020, Coty announced that Pierre Denis will succeed Pierre Laubies as Chief Executive Officer of Coty, and that Pierre-André Terisse will become Chief Operating Officer, while retaining in full his CFO role and responsibilities. In addition, the Coty Board of Directors elected Isabelle Parize and Justine Tan as non-executive directors, effective February 27, 2020.

- On March 25, 2020, Coty announced that it started producing hydro-alcoholic gel, which is used as hand sanitizer, to help combat the COVID-19 virus. The products are being distributed free of charge to emergency services staff, as well as to Coty employees working at plants and distribution centers, and pharmacy staff at select retail customers.

- On March 27, 2020, the Company paid a quarterly dividend of $0.125 per common share. The participation rate in the dividend reinvestment program totaled 65% in the quarter to receive the dividend 50% cash and 50% stock.

- On April 29, 2020, Coty secured a holiday on its leverage covenant for the next 4 quarters, with no change in funding costs.

- As Coty focuses on preserving cash in this critical time, the Company is suspending the dividend through April 1, 2021 or until such later date that it reaches a leverage ratio of 4x.

- On May 11, 2020, Coty announced the expansion of its turnaround plan, targeting to reduce its fixed cost structure by 25% or ~$700M over the next 30 months, with over 2/3 of the savings incremental to the original turnaround plan. These cost reductions will be achieved through a combination of further consolidating its supply network, headcount restructuring, and substantial reduction in its non-people costs. The Company does not expect an increase in its one-time cash costs associated with this cost reduction program, with approximately $500M of one-time cash costs remaining under the previously announced turnaround plan to be spent between FY21-FY23.

- On May 11, Coty commenced a strategic partnership with KKR, resulting in immediate KKR investment of $750M via convertible preferred shares. KKR and Coty are in exclusive talks for a 60/40 partnership for Coty’s Professional Beauty and Retail Hair businesses ($2.35 billion in FY19 revenues) for an enterprise value of $4.3 billion.

Conference Call

Coty Inc. will host a conference call at 8:30 a.m. (ET) today, May 11, 2020 to discuss its results. The dial-in number for the call is (866) 834-4311 in the U.S. or (720) 405-2213 internationally (conference passcode number: 9961349). The live audio webcast and presentation slides will be available at http://investors.coty.com. The conference call will be available for replay.

About Coty Inc

Coty is one of the world’s largest beauty companies with an iconic portfolio of brands across fragrance, color cosmetics, hair color and styling, and skin and body care. Coty is the global leader in fragrance, a strong number two in professional hair color & styling, and number three in color cosmetics. Coty’s products are sold in over 150 countries around the world. Coty and its brands are committed to a range of social causes as well as seeking to minimize its impact on the environment. For additional information about Coty Inc., please visit www.coty.com.