Coty Inc. reports Fiscal 2019 fourth quarter and full year results, in-line with guidance

SHARE WITH :

Financial IMAGES

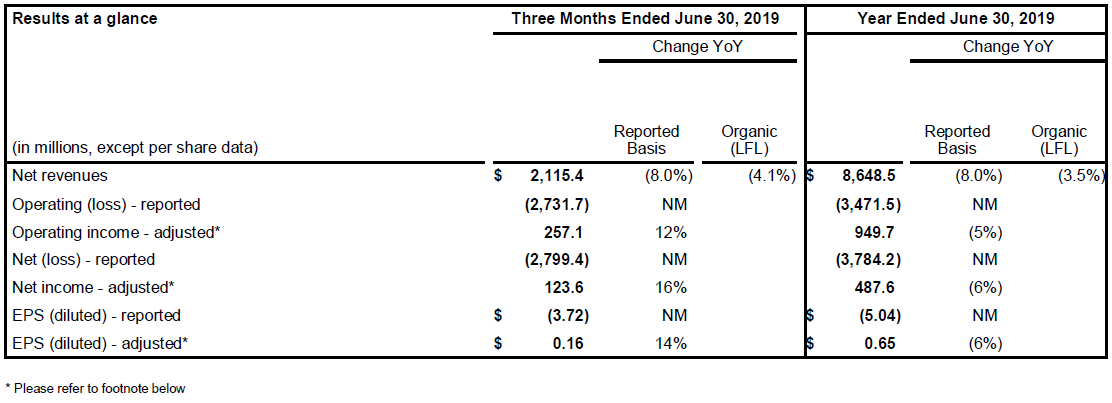

- FY19 Reported EPS ($5.04), Adjusted EPS of $0.65

- FY20 Adjusted EPS Targeted Growth in the Mid-Single Digits

NEW YORK - August 28, 2019-- Coty Inc. (NYSE: COTY) today announced financial results for the fourth quarter and fiscal year ended June 30, 2019.

Highlights

- Results in-line with February guidance

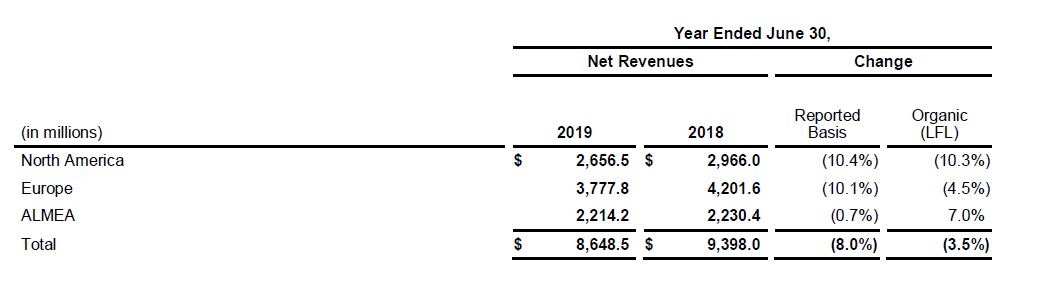

- FY19 net revenues down 8.0%, with LFL decline of 3.5%

- Strong LFL growth in Luxury, offset by decline in Consumer Beauty

- Reported operating income and margin include significant impairment costs as anticipated

- Adjusted operating margin of 11.0%, up 30 bps YoY

- Adjusted EPS of $0.65 down 6%, including 4% FX headwind

- FY19 free cash flow of $213.0 million

Commenting on the operating results, Pierre Laubies, Coty CEO said:

"2019 is the beginning of a new phase in Coty's journey, but I am pleased to start delivering against the targets we shared with you in February, with FY19 adjusted EPS of $0.65, constant currency adjusted operating income of $992 million, and solid cash flow generation. We are now fully engaged in FY20. Our Turnaround Plan focuses on reshaping and simplifying our beauty business to generate fuel for growth and leverage the potential of our Consumer Beauty brands, while continuing to improve growth and margins in our Luxury and Professional Beauty divisions. Our plan will deliver gradually, but we expect dynamics to start changing as soon as this upcoming year, as reflected in our targets for FY20."

Commenting on the financial results, Pierre-André Terisse, Coty CFO said:

"FY19 has been a key milestone, with solid delivery in H2; a thorough review of our assets, including the adjustment of their value in our financial statements; and the strengthening of our financial position and financial policy. This includes a target leverage at 4x net debt to adjusted EBITDA and the confirmation of our dividend, with the option to receive half of it in shares. We now have a clear business and financial framework for the next four years, targeting in FY23 the gradual return to low single digit sales growth, stronger operating margins at 14-16%, and free cash flow above $1 billion. FY20 will be a first step towards these goals, and building on the delivery of FY19, we are confident in the delivery of our targets for the coming year."

FY20 Outlook

- Net Revenues: Stable to slightly lower LFL, starting in 1Q20.

- Adjusted Operating Income: 5-10% YoY growth, at constant FX and portfolio scope, after increased investment behind our brands.

- Adjusted EPS: Mid-single digit growth.

- Free Cash Flow: Moderate improvement YoY.

* These measures, as well as “adjusted gross margin”, “adjusted operating income”, “Net Debt / Adjusted EBITDA ratio”, and “free cash flow,” are Non-GAAP Financial Measures. Refer to “Non-GAAP Financial Measures” for discussion of these measures. Reconciliations from reported to adjusted results can be found at the end of this release. “NM” indicates calculation not meaningful.

Financial Results

Revenues:

- FY19 reported net revenues of $8,648.5 million decreased by 8.0%, with a like-for-like (LFL) revenue decline of 3.5% and negative foreign exchange (FX) impact of 3.6%. The LFL performance reflected strong growth in the Luxury division of 4.7% LFL, offset by a 10.6% LFL decline in the Consumer Beauty division and a 1.7% LFL decline in the Professional Beauty division. FY19 net revenues included $358 million from Younique.

- 4Q19 net revenues of $2,115.4 million decreased by 8.0% and declined by 4.1% on a LFL basis, driven by an 11.5% LFL decline in Consumer Beauty reflecting continued share pressure in the core business and softness in Younique, and a 3.1% LFL decline in Professional Beauty primarily as a result of trade inventory destocking at certain customers. The Luxury division delivered very good 5.8% LFL growth, fueled by Burberry, Gucci, and Calvin Klein.

Gross Margin

- FY19 reported gross margin of 61.8% increased by 20 bps from 61.6% in the prior-year. Our FY19 adjusted gross margin of 61.9% decreased by 40 bps, as solid gross margin expansion in Professional Beauty was offset by margin contraction in Consumer Beauty reflecting country-mix shift and elevated promotional activity.

- 4Q19 reported gross margin of 62.2% increased by 120 bps versus the prior year period, while the adjusted gross margin of 62.1% increased by 20 bps, driven by margin expansion in the Luxury division which also contributed to a greater portion of the revenue mix.

Operating Income:

- FY19 reported operating loss totaled $3,471.5 million, compared to reported operating income of $153.3 million in FY18, and the 4Q19 reported operating loss totaled $2,731.7 million compared to a reported operating loss of $72.1 million in the prior-year period.

- The 4Q19 reported operating loss reflected $2.9 billion non-cash impairment charge primarily connected to the Consumer Beauty division and specific brand trademarks, bringing the FY19 total impairment charge to $3.9 billion. This impairment total includes $3.4 billion of Consumer Beauty goodwill, and $0.4 billion of indefinite-lived trademarks with the majority of the trademark impairment related to several Consumer Beauty brands.

- FY19 adjusted operating income of $949.7 million declined by 5% from $1,002.3 million in the prior year, with negative FX impact accounting for a 4% decline. The broadly stable constant currency adjusted operating income as compared to the prior year was delivered in spite of approximately $100 million of negative impact on our operations from supply chain disruptions, as we actively managed our fixed costs as well as non-working media. FY19 adjusted operating income included $16 million from Younique.

- The FY19 adjusted operating margin expanded 30 bps to 11.0% in FY19, on the back of 320 bps margin expansion in Luxury to 15.5% and 190 bps margin growth in Professional Beauty to 12.1%, partially offset by a 340 bps decline in Consumer Beauty to 6.2%.

- The 4Q19 adjusted operating income of $257.1 million increased 12% from the prior-year period, despite 5% negative impact from FX. The 4Q19 adjusted operating margin grew 220 bps to 12.2%.

Net Income:

- FY19 reported net loss of $3,784.2 million compared to a reported net loss of $168.8 million in the prior-year, and the 4Q19 reported net loss of $2,799.4 million compared to a reported net loss of $181.3 million in the prior-year period.

- The FY19 adjusted net income of $487.6 million declined 6% from $516.3 million in the prior year.

- 4Q19 adjusted net income of $123.6 million increased 16% from $106.6 million in the prior year period.

Earnings Per Share (EPS):

- Our FY19 reported earnings per share of $(5.04) decreased compared to $(0.23) in the prior-year, and the 4Q19 reported EPS of $(3.72) decreased compared to $(0.24) in the prior-year period.

- The FY19 adjusted EPS of $0.65 decreased from $0.69 in the prior-year, and the 4Q19 adjusted EPS of $0.16 improved from $0.14 in the prior-year period.

Operating Cash Flow

- In FY19, net cash provided by operating activities was $639.6 million, up $225.9 million from $413.7 million in FY18, benefiting from the impact of working capital management initiatives, including successful cash collection initiatives for receivables and the net contribution of approximately $118 million from a receivables factoring program. 4Q19 operating cash flow totaled $188.2 million, down $36.6 million from $224.8 million in the prior year period.

- FY19 free cash flow of $213.0 million improved by $245.7 million from negative free cash flow of $(32.7) million in the prior year, reflecting the strong improvement in operating cash flow coupled with a $19.8 million reduction in capex. 4Q19 free cash flow of $92.5 million was stable YoY.

Net Debt:

- Net debt of $7,405.4 million on June 30, 2019 increased by $113.8 million from the balance of $7,291.6 million on June 30, 2018 and increased modestly by $17.2 million from the balance on March 31, 2019. This sequential increase relative to 3Q19 was driven by a negative FX impact of approximately $59 million, partially offset by net debt reduction of approximately $42 million. The net debt reduction was the result of $92.5 million of free cash flow in the quarter and approximately $13 million of other cash inflow, partially offset by $63.4 million of cash dividend payment. At the end of Q4, there was over 20% headroom available under our financial covenants.

Fiscal 2019 Divisional Business Review

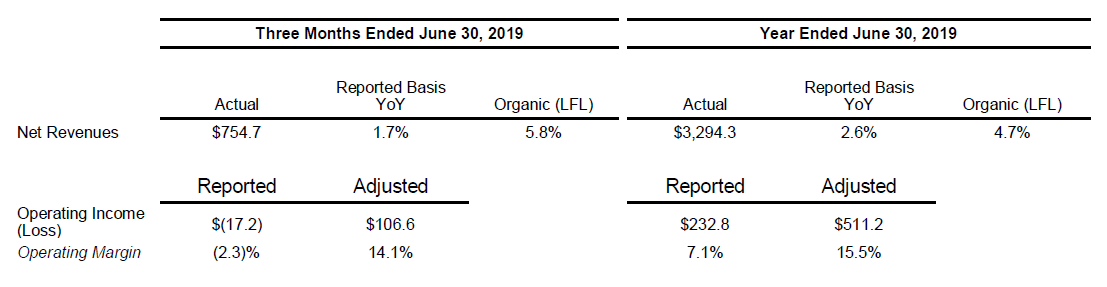

Luxury Division

In FY19, reported Luxury net revenues of $3,294.3 million or 38% of total Coty, increased by 2.6% versus the prior year. On a LFL basis, Luxury net revenues grew by 4.7% in FY19 driven by strength in ALMEA and Europe, and solid performance in Travel Retail despite disproportionate supply chain disruption in this channel in the first half of the year. FY19 marked the second consecutive year of double-digit growth in Luxury's emerging markets, with particular strength in China. By brand, FY19 was fueled by Burberry, Calvin Klein and Gucci, supported by successful launches such as Burberry Her, Gucci Guilty Revolution and Gucci's new Alchemist Garden collection. We also had strong performance in Luxury e-commerce revenues in FY19, with approximately 30% e-commerce net revenue growth, with e-commerce penetration reaching a little over 10%.

In 4Q19, reported Luxury net revenues increased by 1.7% versus the prior year, with very strong LFL growth of 5.8%. ALMEA and Travel Retail were stand-out growth contributors in the quarter, including great performance in China. Growth was led by the Burberry, Gucci, Calvin Klein, Hugo Boss, and Marc Jacobs brands. During the quarter, the performance of Luxury also benefited from the successful May launch of the Gucci lipstick collection, which also represents the initial step in our re-launch of the overall Gucci make-up line.

The Luxury division delivered reported operating income of $232.8 million in FY19, a decrease of 6% versus FY18, while adjusted operating income was $511.2 million, reflecting significant 30% growth from the prior-year. The adjusted operating margin was 15.5%, growing 320 bps versus FY18, driven by fixed cost reductions and lower non-working media. In 4Q19, reported operating loss of $(17.2) million fell from $47.5 million in the prior year period, while adjusted operating income of $106.6 million grew 36% from the prior year period, again supported by net revenue growth and fixed cost management. The adjusted operating margin in 4Q19 was 14.1%, an increase of 360 bps from the prior-year period.

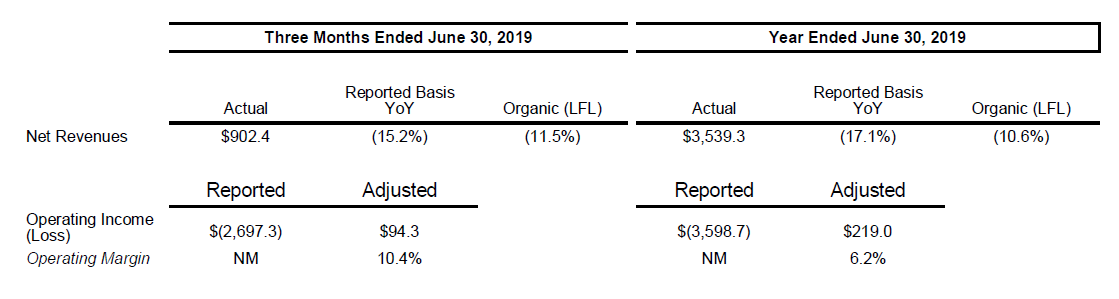

Consumer Beauty

FY19 Consumer Beauty reported net revenues of $3,539.3 million or 41% of total Coty. Revenues declined 17.1% as reported, and decreased 10.6% on a LFL basis. Our sell-out performance remained consistent over the course of the year, declining high single digits, as our brands faced share losses and continued weakness of the mass beauty category in North America and Europe. While our sell-out in North America and Europe declined high single digits, net revenues in these regions - which together accounted for approximately 70% of Consumer Beauty - declined double digits, impacted by elevated promotional activity and trade spending, as well as by the supply chain disruptions at the start of the year. On the other hand, revenues and sell-out in ALMEA grew in the low single digits, supported by consistent strength and share gains in Brazil.

By category in FY19, color cosmetics brands continued to account for close to half of the divisional net revenues and declined in the low teens LFL, reflecting the category pressure in mass cosmetics and market share losses. Retail hair color, which accounted for a mid-teens percentage of net revenues, declined high single digits reflecting stable performance of Wella Retail and declines in Clairol. Body care revenues, accounting for mid-teens percentage of Consumer Beauty, grew moderately fueled by our Brazilian local brands. Mass fragrances accounted for approximately 10% and experienced significant decline. Finally, Younique accounted for approximately 10% of the division, with continuing declines in presenter sponsorships.

In 4Q19, net revenues declined 15.2% as reported and decreased 11.5% LFL, with continuing pressure in Younique. Trends in the core Consumer Beauty categories remained fairly consistent with the prior nine months.

Consumer Beauty's reported operating loss in FY19 of $3,598.7 million compared to reported operating income of $278.9 million in the prior year period, reflecting the division's asset impairment charges of $3.7 billion as well as underlying profit decline. FY19 adjusted operating income declined 47% to $219.0 million. The adjusted operating margin declined by 340 bps to 6.2% due to a reduction in net revenues and gross margin decline, partially offset by lower fixed costs and A&CP management. The 4Q19 reported operating loss totaled $(2,697.3) million as a result of the impairment charge recorded in the quarter, while the adjusted operating income for the quarter of $94.3 million grew 1%.

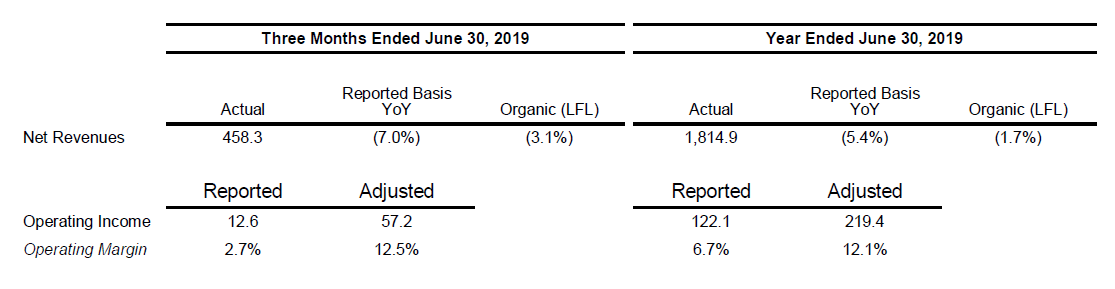

Professional Beauty

Professional Beauty FY19 net revenues of $1,814.9 million or 21% of total Coty, decreased by 5.4% as reported and decreased 1.7% LFL. FY19 was a challenging year for the Professional Beauty division, primarily within the North American region, due to supply chain disruptions coupled with trade inventory reductions at certain key customers. Despite this pressure in North America, the division saw solid growth in ALMEA and very strong growth in ghd globally fueled by new product introductions and improved execution. We also made strong progress in our e-commerce efforts, which reached a low teens percentage of our divisional sales, primarily fueled by our online platforms for Wella and ghd.

4Q19 reported revenues of $458.3 million declined by 7.0% on a reported basis, with a LFL decline of 3.1%, primarily related to weakness in North America stemming from continued de-stocking at key accounts.

Professional Beauty reported operating income was $122.1 million in FY19, a growth of 2% versus the prior year, while adjusted operating income grew 13% to $219.4 million, fueled by gross margin expansion and fixed cost reduction. In 4Q19, reported operating income was $12.6 million compared to $36.2 million in 4Q18, while adjusted operating income was $57.2 million and relatively stable YoY. The Professional Beauty adjusted operating margin of 12.1% grew 190 bps during FY19 driven by higher gross margins and reduced fixed costs.

Fiscal 2019 Business Review by Geographic Region

North America

- North America net revenues of $2,656.5 million, or approximately 31% of total net revenues, decreased 10% as reported and 10% LFL. The overall decline was primarily due to weakness in both Consumer Beauty and Professional Beauty. Consumer Beauty was impacted by a difficult mass beauty market, shelf space losses in several brands, supply chain disruption, as well as ongoing pressure on Younique. Professional Beauty revenues were challenged due to certain key customers' trade inventory reduction as well as supply chain disruptions.

Europe

- Europe net revenues of $3,777.8 million, or approximately 44% of the total, decreased 10% as reported and 5% LFL. The decline is largely related to softness in Consumer Beauty stemming from underlying mass beauty market challenges, market share pressure, and the aforementioned supply chain disruptions. This was partially offset by solid performance in Luxury.

ALMEA

- ALMEA net revenues of $2,214.2 million, or approximately 25% of the total, decreased 1% as reported and grew 7% LFL fueled by very strong momentum in Luxury as well as solid growth for both Professional Beauty and Consumer Beauty. Growth in China, Brazil, and Middle East were strong in FY19.

Cash Flows

- In FY19, net cash provided by operating activities was $639.6 million, up $225.9 million from $413.7 million in FY18, benefiting from the impact of working capital management initiatives, including successful receivable collection initiatives which also resulted in the improvement in the underlying aging. Working capital also benefited from the net contribution of approximately $118 million from a receivables factoring program. 4Q19 operating cash flow totaled $188.2 million from $224.8 million in the prior year period, fueled by approximately $17 million increase in adjusted net income and continued progress on receivables.

- FY19 free cash flow of $213.0 million improved by $245.7 million from negative cash flow of $(32.7) million in the prior year, reflecting the strong improvement in operating cash flow coupled with a $19.8 million reduction in capex. 4Q19 free cash flow of $92.5 million was stable YoY.

- In FY19, we distributed $346.2 million in quarterly cash dividends, including a cash distribution of $63.4 million paid on June 28, 2019. During the quarter, we issued 2.4 million shares as part of the newly initiated dividend reinvestment program.

- Net debt of $7,405.4 million on June 30, 2019 increased by $113.8 million from the balance of $7,291.6 million on June 30, 2018 and increased modestly by $17.2 million from the balance on March 31, 2019. This sequential increase relative to Q3 was driven by a negative FX impact of approximately $59 million, partially offset by net debt reduction of approximately $42 million. The net debt reduction was fueled by the $92.5 million of free cash flow in the quarter and approximately $13 million of other cash inflow, partially offset by $63.4 million of cash dividend payment.

Noteworthy Company Developments

Other noteworthy company developments include:

- On June 28, 2019, we paid a quarterly dividend of $0.125 per common share. This was the first dividend payment following the introduction of the stock dividend reinvestment program. The participation rate in the program totaled 68% in the quarter to receive the dividend 50% cash and 50% stock.

- At the end of June, our credit agreement was amended to expand our operational flexibility and align with our deleverage target. Coty has a very solid balance sheet with significant liquidity and no material maturities until FY23.

- On July 1, 2019, we announced an operational plan to drive substantial improvement in Consumer Beauty while also further optimizing Luxury and Professional Beauty. The Plan focuses on three strategic pillars: rediscover growth, regain operational leadership and build a culture of pride and performance, with the objective to steadily improve gross margin and operating margin, more in line with Coty’s peer group, as well as to drive free cash flow and reduce leverage.

- On August 28, 2019 Coty announced a dividend of $0.125, payable on September 30, 2019 to stockholders of record at the close of business on September 9, 2019.

- In 4Q19, we recorded a non-cash impairment charge primarily connected to the Consumer Beauty division and specific brand trademarks of $2,874.2 million, bringing the FY19 total impairment charge to $3,851.9 million. This impairment total includes $3,391 million of Consumer Beauty goodwill, and $429 million of indefinite-lived trademarks with the majority of the trademark impairment related to several Consumer Beauty brands as well as philosophy and Wella.

Conference Call

Coty Inc. will host a conference call at 8:00 a.m. (ET) today, August 28, 2019 to discuss its results. The dial-in number for the call is (866) 834-4311 in the U.S. or (720) 405-2213 internationally (conference passcode number: 7047837). The live audio webcast and presentation slides will be available at http://investors.coty.com. The conference call will be available for replay.

About Coty Inc.

Coty is one of the world’s largest beauty companies with an iconic portfolio of brands across fragrance, color cosmetics, hair color and styling, and skin and body care. Coty is the global leader in fragrance, a strong number two in professional hair color & styling, and number three in color cosmetics. Coty’s products are sold in over 150 countries around the world. Coty and its brands are committed to a range of social causes as well as seeking to minimize its impact on the environment. For additional information about Coty Inc., please visit www.coty.com.

Forward Looking Statements

Certain statements in this release are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect Coty’s current views with respect to, among other things, Coty’s Turnaround Plan, strategic planning, targets, segment reporting and outlook for future reporting periods (including the extent and timing of revenue, expense, profit trends and EPS and changes in operating cash flows and cash flows from operating activities and investing activities), its future operations and strategy, ongoing and future cost efficiency and restructuring initiatives and programs, strategic transactions (including their expected timing and impact), investments, licenses and portfolio changes, synergies, savings, performance, cost, timing and integration of acquisitions, future cash flows, liquidity and borrowing capacity, timing and size of cash outflows and debt deleveraging, impact and timing of supply chain disruptions and the resolution thereof, timing and extent of any future impairments, and synergies, savings, impact, cost, timing and implementation of its Turnaround Plan, including operational and organizational structure changes, operational execution and simplification initiatives, the move of Coty’s headquarters, and the priorities of senior management. These forward-looking statements are generally identified by words or phrases, such as “anticipate”, “are going to”, “estimate”, “plan”, “project”, “expect”, “believe”, “intend”, “foresee”, “forecast”, “will”, “may”, “should”, “outlook”, “continue”, “temporary”, “target”, “aim”, “potential”, “goal” and similar words or phrases. These statements are based on certain assumptions and estimates that Coty considers reasonable, but are subject to a number of risks and uncertainties, many of which are beyond Coty’s control, which could cause actual events or results (including our financial condition, results of operations, cash flows and prospects) to differ materially from such statements, including risks and uncertainties relating to:

- Coty’s ability to successfully implement its multi-year Turnaround Plan, including its management headquarters relocation and management realignment, and to develop and achieve its global business strategies, compete effectively in the beauty industry and achieve the benefits contemplated by its strategic initiatives within the expected time frame or at all;

- Coty’s ability to anticipate, gauge and respond to market trends and consumer preferences, which may change rapidly, and the market acceptance of new products, including any relaunched or rebranded products and the anticipated costs and discounting associated with such relaunches and rebrands, and consumer receptiveness to its current and future marketing philosophy and consumer engagement activities (including digital marketing and media);

- use of estimates and assumptions in preparing Coty’s financial statements, including with regard to revenue recognition, stock compensation expense, income taxes (including the expected timing and amount of the release of any tax valuation allowance), the assessment of goodwill, other intangible and long-lived assets for impairments, the market value of inventory, pension expense, the fair value of redeemable noncontrolling interests and the fair value of acquired assets and liabilities associated with acquisitions;

- the impact of any future impairments;

- managerial, transformational, operational, regulatory, legal and financial risks, including diversion of management attention to and management of cash flows, expenses and costs associated with the Turnaround Plan and future strategic initiatives;

- future acquisitions and the integration thereof with Coty’s business, operations, systems, financial data and culture and the ability to realize synergies, avoid future supply chain and other business disruptions, reduce costs (including through its cash efficiency initiatives) and realize other potential efficiencies and benefits (including through Coty’s restructuring initiatives) at the levels and at the costs and within the time frames contemplated or at all;

- increased competition, consolidation among retailers, shifts in consumers’ preferred distribution and marketing channels (including to digital and luxury channels), distribution and shelf-space resets or reductions, compression of go-to-market cycles, changes in product and marketing requirements by retailers, reductions in retailer inventory levels and order lead-times or changes in purchasing patterns, and other changes in the retail, e-commerce and wholesale environment in which Coty does business and sells its products and its ability to respond to such changes;

- Coty and its brand business partners’ and licensors’ abilities to obtain, maintain and protect the intellectual property used in its and their respective businesses, protect our and their respective reputations (including those of its and their executives or influencers) and public goodwill, and defend claims by third parties for infringement of intellectual property rights;

- any change to Coty’s capital allocation and/or cash management priorities, including any change in its dividend reinvestment program and policy;

- any unanticipated problems, liabilities or integration or other challenges associated with a past or future acquired business which could result in increased risk or new, unanticipated or unknown liabilities, including with respect to environmental, competition and other regulatory, compliance or legal matters;

- Coty’s international operations and joint ventures, including enforceability and effectiveness of its joint venture agreements and reputational, compliance, regulatory, economic and foreign political risks, including difficulties and costs associated with maintaining compliance with a broad variety of complex local and international regulations;

- Coty’s dependence on certain licenses (especially in its Luxury division) and its ability to renew expiring licenses on favorable terms;

- Coty’s dependence on entities performing outsourced functions, including outsourcing of distribution functions, and third-party manufacturers, logistics and supply-chain suppliers and other suppliers, including third party software providers;

- administrative, development and other difficulties in meeting the expected timing of market expansions, product launches and marketing efforts;

- global political and/or economic uncertainties, disruptions or major regulatory or policy changes, and/or the enforcement thereof that affect Coty’s business, financial performance, operations or its products, including the impact of Brexit, the current U.S. administration, changes in the U.S. tax code, and recent changes and future changes in tariffs, retaliatory or trade protection measures, trade policies and other international trade regulations in the U.S., the European Union and Asia and in other regions where Coty operates;

- currency exchange rate volatility and currency devaluation;

- the number, type, outcomes (by judgment, order or settlement) and costs of any current or future legal, compliance, tax, regulatory or administrative proceedings, investigations and/or litigation, including litigation relating to the tender offer by Cottage Holdco B.V. (the “Cottage Tender Offer”);

- Coty’s ability to manage seasonal factors and other variability and to anticipate future business trends and needs;

- disruptions in operations, sales and in other areas, including due to disruptions in Coty’s supply chain, restructurings and other business alignment activities, the move of Coty’s headquarters to Amsterdam, manufacturing or information technology systems, labor disputes, extreme weather and natural disasters, and the impact of such disruptions on Coty’s ability to generate profits, stabilize or grow revenues or cash flows, comply with its contractual obligations and accurately forecast demand and supply needs and/or future results;

- restrictions imposed on Coty through its license agreements, credit facilities and senior unsecured bonds, or other material contracts, Coty’s ability to generate cash flow to repay, refinance or recapitalize debt and otherwise comply with its debt instruments, and changes in the manner in which Coty finances its debt and future capital needs;

- increasing dependency on information technology and Coty’s ability to protect against service interruptions, data corruption, cyber-based attacks or network security breaches, costs and timing of implementation and effectiveness of any upgrades or other changes to information technology systems, and the cost of compliance or its failure to comply with any privacy or data security laws (including the European Union General Data Protection Regulation (the “GDPR”) and the California Consumer Privacy Act) or to protect against theft of customer, employee and corporate sensitive information;

- Coty’s ability to attract and retain key personnel and the impact of senior management transitions and organizational structure changes, including the co-location of key business leaders and functions in Amsterdam;

- the distribution and sale by third parties of counterfeit and/or gray market versions of the Coty’s products; the impact of the Cottage Tender Offer and of Coty’s Turnaround Plan on its relationships with key customers and suppliers and certain material contracts;

- Coty’s relationship with Cottage Holdco B.V., as our majority stockholder, and its affiliates, and any related conflicts of interest or litigation;

- future sales of a significant number of shares by Coty’s majority stockholder or contractually by certain commercial banks on behalf of Coty’s majority stockholder, as may be required to satisfy obligations under such majority stockholder's credit agreement, or the perception that such sales could occur; and

- other factors described elsewhere in this document and in documents that Coty files with the SEC from time to time.

When used herein, the term “includes” and “including” means, unless the context otherwise indicates, including without limitation. More information about potential risks and uncertainties that could affect Coty’s business and financial results is included under the heading “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in Coty’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2019 and other periodic reports Coty has filed and may file with the SEC from time to time.

All forward-looking statements made in this release are qualified by these cautionary statements. These forward-looking statements are made only as of the date of this release, and Coty does not undertake any obligation, other than as may be required by law, to update or revise any forward-looking or cautionary statements to reflect changes in assumptions, the occurrence of events, unanticipated or otherwise, or changes in future operating results over time or otherwise.

Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance unless expressed as such and should only be viewed as historical data.

Non-GAAP Financial Measures

The Company operates on a global basis, with the majority of net revenues generated outside of the U.S. Accordingly, fluctuations in foreign currency exchange rates can affect results of operations. Therefore, to supplement financial results presented in accordance with GAAP, certain financial information is presented excluding the impact of foreign currency exchange translations to provide a framework for assessing how the underlying businesses performed excluding the impact of foreign currency exchange translations (“constant currency”). Constant currency information compares results between periods as if exchange rates had remained constant period-over-period, with the current period’s results calculated at the prior-year period’s rates. The Company calculates constant currency information by translating current and prior-period results for entities reporting in currencies other than U.S. dollars into U.S. dollars using constant foreign currency exchange rates. The constant currency calculations do not adjust for the impact of revaluing specific transactions denominated in a currency that is different to the functional currency of that entity when exchange rates fluctuate. The constant currency information presented may not be comparable to similarly titled measures reported by other companies. The Company discloses the following constant currency financial measures: net revenues, organic like-for-like (LFL) net revenues, adjusted gross profit and adjusted operating income.

The Company presents period-over-period comparisons of net revenues on a constant currency basis, as well as on an organic (LFL) basis. The Company believes that organic (LFL) period-over-period better enables management and investors to analyze and compare the Company's net revenues performance from period to period. For the periods described in this release, the term “like-for-like” describes the Company's core operating performance, excluding the financial impact of (i) acquired brands or businesses in the current year period until we have twelve months of comparable financial results, (ii) divested brands or businesses or early terminated brands in the prior year period to maintain comparable financial results with the current fiscal year period and (iii) foreign currency exchange translations to the extent applicable. For a reconciliation of organic (LFL) period-over-period, see the table entitled “Reconciliation of Reported Net Revenues to Like-For-Like Net Revenues”. For a reconciliation of the Company's organic (LFL) period-over-period by segment and geographic region, see the tables entitled “Net Revenues and Adjusted Operating Income by Segment” and “Net Revenues by Geographic Region."

The Company presents operating income, operating income margin, gross profit, gross margin, effective tax rate, net income, net income margin, net revenues and EPS (diluted) on a non-GAAP basis and specifies that these measures are non-GAAP by using the term “adjusted”. The Company believes these non-GAAP financial measures better enable management and investors to analyze and compare operating performance from period to period. In calculating adjusted operating income, operating income margin, gross profit, gross margin, effective tax rate, net income, net income margin and EPS (diluted), the Company excludes the following items:

- Costs related to acquisition activities: We have excluded acquisition-related costs and acquisition accounting impacts such as those related to transaction costs and costs associated with the revaluation of acquired inventory in connection with business combinations because these costs are unique to each transaction. The nature and amount of such costs vary significantly based on the size and timing of the acquisitions and the maturities of the businesses being acquired. Also, the size, complexity and/or volume of past acquisitions, which often drives the magnitude of such expenses, may not be indicative of the size, complexity and/or volume of any future acquisitions.

- Restructuring and other business realignment costs: We have excluded costs associated with restructuring and business structure realignment programs to allow for comparable financial results to historical operations and forward-looking guidance. In addition, the nature and amount of such charges vary significantly based on the size and timing of the programs. By excluding the referenced expenses from our non-GAAP financial measures, our management is able to further evaluate our ability to utilize existing assets and estimate their long-term value. Furthermore, our management believes that the adjustment of these items supplements the GAAP information with a measure that can be used to assess the sustainability of our operating performance.

- Amortization expense: We have excluded the impact of amortization of finite-lived intangible assets, as such non-cash amounts are inconsistent in amount and frequency and are significantly impacted by the timing and/or size of acquisitions. Our management believes that the adjustment of these items supplements the GAAP information with a measure that can be used to assess the sustainability of our operating performance. Although we exclude amortization of intangible assets from our non-GAAP expenses, our management believes that it is important for investors to understand that such intangible assets contribute to revenue generation. Amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Any future acquisitions may result in the amortization of additional intangible assets.

- Asset impairment charges: We have excluded the impact of asset impairments as such non-cash amounts are inconsistent in amount and frequency and are significantly impacted by the timing and/or size of acquisitions. Our management believes that the adjustment of these items supplements the GAAP information with a measure that can be used to assess the sustainability of our operating performance.

- Loss/(Gain) on sale of brand assets: We have excluded the impact of Loss/(gain) on sale of brand assets as such amounts are inconsistent in amount and frequency and are significantly impacted by the size of divestitures. Our management believes that the adjustment of these items supplements the GAAP information with a measure that can be used to assess the sustainability of our operating performance.

- Interest (income) expense: We have excluded foreign currency impacts associated with acquisition-related and debt financing-related forward contracts, as well as debt financing transaction costs as the nature and amount of such charges are not consistent and are significantly impacted by the timing and size of such transactions.

- Other expense (income): We have excluded the impact of costs incurred for legal and advisory services rendered in connection with the evaluation of the tender offer initiated by certain of our shareholders. Our management believes these costs do not reflect our underlying ongoing business, and the adjustment of such costs helps investors and others compare and analyze performance from period to period. We have also excluded the impact of pension curtailment (gains) and losses and pension settlements as such events are triggered by our restructuring and other business realignment activities and the amount of such charges vary significantly based on the size and timing of the programs.

- Loss on early extinguishment of debt: We have excluded loss on extinguishment of debt as this represents a non-cash charge, and the amount and frequency of such charges is not consistent and is significantly impacted by the timing and size of debt financing transactions.

- Noncontrolling interest: This adjustment represents the after-tax impact of the non-GAAP adjustments included in Net income attributable to noncontrolling interests based on the relevant non-controlling interest percentage.

- Tax: This adjustment represents the impact of the tax effect of the pretax items excluded from Adjusted net income. The tax impact of the non-GAAP adjustments is based on the tax rates related to the jurisdiction in which the adjusted items are received or incurred.

The Company has provided a quantitative reconciliation of the difference between the non-GAAP financial measures and the financial measures calculated and reported in accordance with GAAP. For a reconciliation of adjusted gross profit to gross profit, adjusted EPS (diluted) to EPS (diluted), and adjusted net revenues to net revenues, see the table entitled “Reconciliation of Reported to Adjusted Results for the Consolidated Statements of Operations.” For a reconciliation of adjusted operating income to operating income and adjusted operating income margin to operating income margin, see the tables entitled “Reconciliation of Reported Operating Income (Loss) to Adjusted Operating Income” and "Reconciliation of Reported Operating Income (Loss) to Adjusted Operating Income by Segment." For a reconciliation of adjusted effective tax rate and adjusted cash tax rate to effective tax rate, see the table entitled “Reconciliation of Reported (Loss) Income Before Income Taxes and Effective Tax Rates to Adjusted Income Before Income Taxes and Effective Tax Rates.” For a reconciliation of adjusted net income and adjusted net income margin to net income (loss), see the table entitled “Reconciliation of Reported Net (Loss) Income to Adjusted Net Income.”

The Company also presents free cash flow, adjusted earnings before interest, taxes, depreciation and amortization (“EBITDA”) and net debt. Management believes that these measures are useful for investors because it provides them with an important perspective on the cash available for debt repayment and other strategic measures and provides them with the same measures that management uses as the basis for making resource allocation decisions. Free cash flow is defined as net cash provided by operating activities, less capital expenditures, adjusted EBITDA is defined as adjusted operating income less depreciation and net debt is defined as total debt less cash and cash equivalents. For a reconciliation of Free Cash Flow, see the table entitled “Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow,” for adjusted EBITDA, see the table entitled “Reconciliation of Adjusted Operating Income to Adjusted EBITDA” and for net debt, see the table entitled “Reconciliation of Total Debt to Net Debt.”

These non-GAAP measures should not be considered in isolation, or as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

To the extent that the Company provides guidance, it does so only on a non-GAAP basis and does not provide reconciliations of such forward-looking non-GAAP measures to GAAP due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation, including adjustments that could be made for restructuring, integration and acquisition-related expenses, amortization expenses, adjustments to inventory, and other charges reflected in its reconciliation of historic numbers, the amount of which, based on historical experience, could be significant.

Additional Tables

Click here for Additional Tables.

For more information contact :

Investor Relations

Olga Levinzon, +1 212 389-7733

Media

Lisa Kessler, +917 - 348 - 3373

Arnaud Leblin, + 33 1 58 71 72 00