Coty Inc. Reports Fiscal Second Quarter 2020 Results

SHARE WITH :

Financial IMAGES

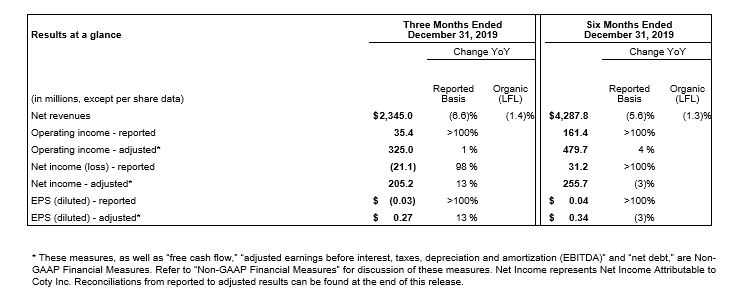

- Q2 Results In-line with Expectations

- Strong Progress on Turnaround Pillars of Gross Margin and Cash Flow

- Full Year FY20 Outlook Confirmed

NEW YORK - February 5, 2020 -- Coty Inc. (NYSE: COTY) today announced financial results for the second quarter of fiscal year 2020, ended December 31, 2019.

Highlights

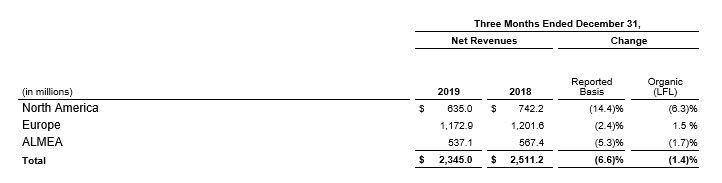

- 2Q20 net revenue decreased 6.6%, with 1.4% organic LFL decline

- LFL growth in Luxury and Professional Beauty was offset by a decline in Consumer Beauty

- 2Q20 adjusted operating income of $325.0 million grew 1% YoY

- In 1H20, adjusted operating income grew 8.5% on a constant currency and scope basis

- Adjusted EPS of $0.27, rose 13% YoY, including a one-time tax benefit of $0.015 per share

- 2Q20 free cash flow of $363.5 million improved by $169.6 million from the prior year period, bringing the total free cash flow for the first half to $317.0 million

Commenting on the operating results, Pierre Laubies, Coty CEO said:

"Our turnaround plan has now been underway for two quarters, and we are confident that the actions we are taking will build a much healthier business and growth. We saw momentum across many of our priority Luxury brands, including Burberry, Gucci, Tiffany and Hugo Boss, while continuing to grow our footprint in Luxury color cosmetics. Our global sell-out trends continue to improve in key mass beauty categories, and brands like Sally Hansen and Rimmel are gaining share in several core countries. The organization remains vigilant in driving strong gross margin improvement, activating the levers at the center of our strategy: mix management, select price increases, more disciplined promotions, and foregoing low value sales. This has allowed us to continue to increase the working media investments behind our brands. Although we are in the early stages of deploying our strategy and much work remains ahead, we continue to be very enthusiastic about the business we are building and our growth prospects."

Commenting on the financial results, Pierre-André Terisse, Coty CFO said:

"Our second quarter results were in-line with our expectations, and underpinned by strong results in our gross margin and free cash flow generation. This makes me confident in our ability to achieve our targets for the year. In the second half, we will start implementing restructuring and supply chain improvement, as per our turnaround plan. Additionally, we are progressing as planned with our strategic review, with strong interest from multiple parties, and continue to target a decision by this summer. Last, we have now commenced a strategic partnership with Kylie Jenner, and we look forward to building a high growth, digitally native beauty brand. In sum, we are continuing to execute on the three pillars of our roadmap, including implementing our turnaround plan, refocusing on our core fragrances, cosmetics and skincare businesses in conjunction with a substantially improved leverage profile, and amplifying our growth potential."

FY20 Outlook

The FY20 outlook remains unchanged:

- Net Revenues: Stable to slightly lower LFL

- Adjusted Operating Income: 5-10% YoY growth, at constant FX and portfolio scope, after increased working media investment behind our brands

- Adjusted EPS: Mid-single digit growth.

- Free Cash Flow: Moderate improvement YoY.

Financial Results

Revenues:

- 2Q20 reported net revenues of $2,345.0 million decreased 6.6% year-over-year, including a negative foreign exchange (FX) impact of 1.6%. Like-for-like (LFL) revenue decreased 1.4% . The LFL performance was driven by a decline in the Consumer Beauty division of 6.7% LFL, partially offset by solid growth in the Professional Beauty and Luxury divisions of 2.2% and 1.3% LFL, respectively.

- Year-to-date reported net revenues of $4,287.8 million decreased by 5.6%, with a LFL revenue decline of 1.3%. The LFL decline was driven by softness within Consumer Beauty, even as performance in the division improved sequentially.

Gross Margin:

- 2Q20 reported gross margin of 63.4% increased by 150 bps from the prior-year period, while the adjusted gross margin of 63.4% increased by 130 bps, driven by the mix shift toward the higher-margin Luxury and Professional Beauty divisions, as well as strong gross margin expansion in the Luxury division.

- Year-to-date reported gross margin of 62.7% was up 160 bps from the prior year, while the adjusted gross margin of 62.7% increased by 140 bps, fueled by the mix shift toward the Luxury and Professional Beauty divisions and the strong progress in the Luxury division.

Operating Income:

- 2Q20 reported operating income of $35.4 million increased versus a 2Q19 reported operating loss of $804.6 million, due to the $965 million impairment charge in the prior year partially offset by an increase in the restructuring charges.

- 2Q20 adjusted operating income of $325.0 million rose 0.8% from the prior year, despite foreign exchange headwinds of approximately 2%. The adjusted operating margin of 13.9% increased 110 bps from the prior-year period. This operating margin expansion reflects the strong gross margin, partially offset by higher SG&A, as increased working media and bad debt expense were balanced by strong non-working media and cost controls.

- Year-to-date reported operating income of $161.4 million compared to reported operating loss of $825.3 million in the prior year due to the impairment charge in the prior year. Year-to-date adjusted operating income of $479.7 million rose by 3.6% from the prior year, with a margin of 11.2%. Year-to-date adjusted operating income grew 8.5% on a constant currency and scope basis, excluding Younique's adjusted operating income of $9.4 million in the prior year.

Net Income:

- 2Q20 reported net loss of $21.1 million compared to a reported net loss of $960.6 million in the prior-year period. The adjusted net income of $205.2 million increased from $181.9 million in 2Q19, reflecting the increase in adjusted operating income coupled with a one-time tax benefit of $11.8 million related to resolution of foreign uncertain tax positions.

- Year-to-date reported net income of $31.2 million compared to a reported net loss of $972.7 million in the prior-year, while the adjusted net income of $255.7 million decreased 3% due tax benefits which were $18 million higher on a net basis in the prior year.

Earnings Per Share (EPS):

- 2Q20 reported loss per share of $(0.03) improved from $(1.28) in the prior year period. The adjusted EPS of $0.27 increased year-over-year due to the aforementioned increase in adjusted net income and a $0.015 EPS contribution from the one-time tax benefit.

- Year-to-date reported earnings per share of $0.04 increased from $(1.30) in the prior-year, and the adjusted EPS of $0.34 is a penny below the prior year due to the prior-year's higher net tax benefit.

Operating Cash Flow:

- In 2Q20, net cash provided by operating activities was $422.1 million, a $102.5 million increase from the prior year period. The operating cash flow was driven by strong underlying progress in reducing aging receivables and inventory. First half operating cash flow totaled $462.0 million, up $224.3 million from the prior year period, driven by an $88 million contribution from factoring, strong underlying working capital improvement and profit growth.

- Our 2Q20 free cash flow of $363.5 million improved by $169.6 million from the prior year period, fueled by the operating cash flow increase and a $67.1 million decrease in capex. First half free cash flow of $317.0 million increased by $338.6 million from the prior year.

Dividend and Net Debt:

- On February 5, 2020, Coty announced a dividend of $0.125 per share payable on March 27, 2020 to holders of record on February 18, 2019.

- Net debt of $7,205.9 million on December 31, 2019 decreased by $160.2 million from the balance of $7,366.1 million on September 30, 2019. The net debt decline was driven by the free cash inflow of $363.5 million, partially offset by a negative FX impact of $102 million and dividend payment of $66.1 million.

- This resulted in a last twelve months Net debt to adjusted EBITDA ratio of 5.3x, an improvement from the 5.5x reported ratio as of September 30, 2019.

Second Quarter Fiscal 2020 Business Review by Segment

Luxury

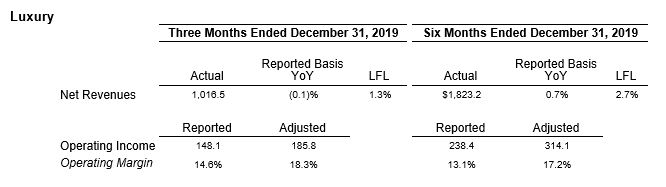

In 2Q20, reported Luxury net revenues of $1,016.5 million decreased by 0.1% versus the prior year. On a LFL basis, Luxury net revenues increased by 1.3% on a high base, fueled by growth in Travel Retail, ALMEA, and Europe. North America declined as a result of a very difficult comparison in the year-ago period following Hurricane-related shipment push-outs into 2Q19, as well as reduced holiday giftset activity as part of our effort to build a healthier business.

2Q20 results were supported by strength in Burberry, Gucci, Tiffany, Hugo Boss, and Lacoste, fueled by strong innovation. In particular, the launch of Tiffany & Love broadened the brand reach to both female and male fragrances, driving market share gains in our core markets. Our early stage expansion into luxury cosmetics continued to progress well, with Gucci lipstick gradually broadening its distribution, including a very successful launch in China in November 2019, setting the stage for the broadening of the cosmetics range in the coming quarters.

The teams have prepared a number of innovations which will be launched from Q3 onwards. In parallel, with a view to strengthen the quality of our business, we have been cutting low value sales since January, which will temporarily drive weak sell-in trends in Q3.

The Luxury division delivered reported operating income of $148.1 million, an increase of 30% vs. the prior-year period. 2Q20 adjusted operating income was $185.8 million, reflecting solid 5% growth from the prior year. The 2Q20 adjusted operating margin was 18.3%, an increase of 90 bps versus 2Q19, driven by over 100 bps of gross margin expansion.

Consumer Beauty

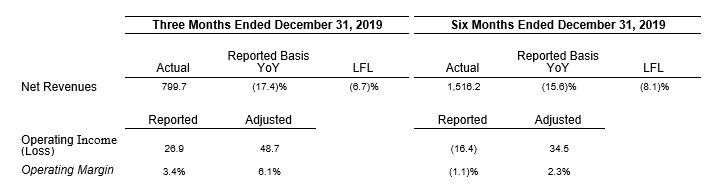

2Q20 Consumer Beauty net revenues of $799.7 million declined 17.4% on a reported basis and declined 6.7% LFL. Even as the global mass beauty market in tracked channels has weakened moderately in recent months to a decline of approximately 3-4%, global sell-out trends for our brands have continued to show gradual improvement, declining in the mid-single digits in recent months. On a sell-in basis, our Europe revenues declined moderately in Q2, reflecting the low single digit mass beauty market declines and gradual progress in our performance. In North America, revenues remain pressured by shelf space losses and some weakening in the mass beauty market. ALMEA sales continued to be pressured by our proactive decision to reduce sales to lower value channels in select countries in support of our gross margin expansion agenda, even as our sell-out in the region remained solid.

By category, net revenue in color cosmetics continued to decline high single digits. Within color cosmetics, we have improved our underperformance relative to the overall category, supported by market share gains in some of our priority brands including Rimmel in the U.K., Max Factor in Germany, Sally Hansen in the U.S., and Cover Girl in Canada. In retail hair, revenues continued to decline low single digits. In body care and mass fragrances, revenues declined in total, though our core brands adidas and Bruno Banani drove sell-out growth. As we continued to be deliberate in our resource allocation, we concentrated our working media investments behind our priority brand and country combinations, with revenues in these priority businesses declining low single digits, in line with 1Q20.

Reported operating income in 2Q20 of $26.9 million increased compared to reported operating loss of $906.9 million in the prior year period. The 2Q20 adjusted operating income of $48.7 million decreased from $54.1 million in the prior year period. However, the adjusted operating margin increased 50 bps to 6.1%, as a solid increase in working media was more than offset by control of non-working media spending.

Professional Beauty

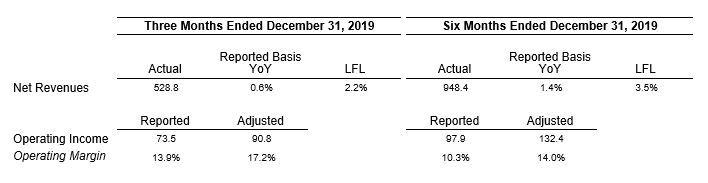

Professional Beauty 2Q20 net revenues of $528.8 million rose by 0.6%, with LFL increasing 2.2%. The quarter was driven by continued strength of ghd and low single digit growth in the hair brands. Europe grew in the quarter, largely driven by distribution gains of Nail products. ALMEA sales were relatively flat, and North America declined slightly, due to declines in Nail.

Professional Beauty reported operating income of $73.5 million decreased from $73.8 million in the prior year period, while adjusted operating income was relatively flat at $90.8 million. The Professional Beauty division adjusted operating margin of 17.2% declined 10 bps from prior period.

Second Quarter Fiscal 2020 Business Review by Geographic Region

North America

- North America net revenues of $635.0 million, or approximately 27% of total net revenues, declined 14.4% as reported and declined 6.3% LFL. The LFL performance continued to be impacted by ongoing mass beauty challenges and shelf space losses in Consumer Beauty, as well as very high comparables in the prior year in Luxury due to shipment timing.

Europe

- Europe net revenues of $1,172.9 million, or approximately 50% of total net revenues, declined 2.4% on a reported basis, but increased 1.5% on a LFL basis. The LFL strength was driven by growth in Luxury, particularly Travel Retail, and Professional Beauty.

ALMEA

- ALMEA net revenues of $537.1 million, or approximately 23% of total net revenues, decreased 5.3% as reported, and decreased 1.7% on a LFL basis. The LFL decline continued to be driven by proactive reduction in lower value channel Consumer Beauty sales in select countries as well as distributor negotiations in the Middle East and Latin America. Encouragingly, Luxury sales accelerated during 2Q20, benefiting from strong growth in China and distribution expansion of Gucci makeup.

Cash Flows

- In 2Q20, net cash provided by operating activities was $422.1 million, a $102.5 million increase from the prior year period. The operating cash flow was driven by strong underlying progress in reducing aging receivables and inventory.

- Our 2Q20 free cash flow of $363.5 million improved by $169.6 million from the prior year period, fueled by the operating cash flow increase and a $67.1 million decrease in capex.

- In 2Q20, we distributed $67.1 million in cash dividends and issued 2.4 million shares as part of the dividend reinvestment program.

- Net debt of $7,205.9 million on December 31, 2019 decreased by $160.2 million from the balance of $7,366.1 million on September 30, 2019, driven by the free cash inflow of $363.5 million, partially offset by a negative FX impact of $102 million and dividend payment of $66.1 million.

Other Company Developments

Today Coty announced its new sustainability strategy titled, “Beauty that Lasts”, with updated targets focusing on three pillars: people, products and planet. The sustainability strategy is part of the company’s Turnaround Plan to build a better business for all stakeholders while making a positive contribution towards achieving a more sustainable and equitable world. This strategy reinforces Coty’s continued support of the UN Global Compact Ten Principles which was announced five years ago.

Other company developments include:

- On December 27, 2019, the Company paid a quarterly dividend of $0.125 per common share. The participation rate in the program totaled 65% in the quarter to receive the dividend 50% cash and 50% stock.

- Effective January 1, 2020, Coty implemented its new organizational structure. As a result, the Company plans to start reporting its financial results under this new divisional structure as of 3Q FY20.

- On January 6, 2020, Coty completed the transaction to create a long-term strategic partnership with Kylie Jenner to jointly build and further develop Kylie's existing beauty business. Under the terms of the agreement, Coty acquired a 51% stake in the partnership for $600 million.

- On February 5, 2020, Coty announced a dividend of $0.125, payable on March 27, 2020 to holders of record on February 18, 2020.

Conference Call

Coty Inc. will host a conference call at 8:00 a.m. (ET) today, February 5, 2020 to discuss its results. The dial-in number for the call is (866) 834-4311 in the U.S. or (720) 405-2213 internationally (conference passcode number: 1766567). The live audio webcast and presentation slides will be available at https://investors.coty.com. The conference call will be available for replay.

About Coty Inc.

Coty is one of the world’s largest beauty companies with an iconic portfolio of brands across fragrance, color cosmetics, hair color and styling, and skin and body care. Coty is the global leader in fragrance, a strong number two in professional hair color & styling, and number three in color cosmetics. Coty’s products are sold in over 150 countries around the world. Coty and its brands are committed to a range of social causes as well as seeking to minimize its impact on the environment. For additional information about Coty Inc., please visit www.coty.com.

Forward Looking Statements

Certain statements in this Earnings Release are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect the Company's current views with respect to, among other things, the Company’s turnaround plan announced on July 1, 2019 (the "Turnaround Plan"), strategic planning, targets, segment reporting and outlook for future reporting periods (including the extent and timing of revenue, expense and profit trends and changes in operating cash flows and cash flows from operating activities and investing activities), the strategic review of its Professional Beauty business, associated hair and nail brands sold by the Consumer Beauty division and Brazilian operations and any transaction related thereto, including divestiture (the “Strategic Review”), including timing of such Strategic Review and any transaction and the use of proceeds from any such transaction, its future operations and strategy, ongoing and future cost efficiency and restructuring initiatives and programs, strategic transactions (including their expected timing and impact), investments, licenses and portfolio changes, synergies, savings, performance, cost, timing and integration of acquisitions (including the strategic partnership with Kylie Jenner), future cash flows, liquidity and borrowing capacity, timing and size of cash outflows and debt deleveraging, the performance of launches or relaunches, the timing and impact of current or future destocking or shelf spaces losses, impact and timing of supply chain disruptions and the resolution thereof, timing and extent of any future impairments, and synergies, savings, impact, cost, timing and implementation of the Company’s Turnaround Plan, including operational and organizational structure changes, segment reporting changes, operational execution and simplification initiatives, the move of the Company’s headquarters, and the priorities of senior management. These forward-looking statements are generally identified by words or phrases, such as “anticipate”, “are going to”, “estimate”, “plan”, “project”, “expect”, “believe”, “intend”, “foresee”, “forecast”, “will”, “may”, “should”, “outlook”, “continue”, “temporary”, “target”, “aim”, “potential” and similar words or phrases. These statements are based on certain assumptions and estimates that we consider reasonable, but are subject to a number of risks and uncertainties, many of which are beyond our control, which could cause actual events or results (including our financial condition, results of operations, cash flows and prospects) to differ materially from such statements, including risks and uncertainties relating to:

- the Company’s ability to successfully implement its multi-year Turnaround Plan, including its management headquarters relocation, management realignment, reporting structure changes, segment reporting changes and operational execution and simplification initiatives, and to develop and achieve its global business strategies (including mix management, select price increases, more disciplined promotions, and foregoing low value sales), compete effectively in the beauty industry and achieve the benefits contemplated by its strategic initiatives (including revenue growth, cost control, gross margin growth and debt deleveraging) within the expected time frame or at all;

- the result of the Strategic Review and whether such Strategic Review will result in any transactions or divestitures (whether relating to all or part of the businesses in scope of the review), the timing, costs and impacts of any such transactions or divestitures, and the amount and use of proceeds from any such transactions;

- the Company’s ability to anticipate, gauge and respond to market trends and consumer preferences, which may change rapidly, and the market acceptance of new products, including new products related to Kylie Jenner’s existing beauty business, any relaunched or rebranded products and the anticipated costs and discounting associated with such relaunches and rebrands, and consumer receptiveness to its current and future marketing philosophy and consumer engagement activities (including digital marketing and media);

- use of estimates and assumptions in preparing the Company’s financial statements, including with regard to revenue recognition, income taxes, the assessment of goodwill, other intangible assets and long-lived assets for impairment, the market value of inventory, and the fair value of acquired or divested assets and liabilities associated with acquisitions or divestitures;

- the impact of any future impairments;

- managerial, transformational, operational, regulatory, legal and financial risks, including diversion of management attention to and management of cash flows, expenses and costs associated with the Turnaround Plan, the Strategic Review, and any related transaction, including divestitures, integration of the strategic partnership with Kylie Jenner, and future strategic initiatives and, in particular, the Company's ability to manage and execute many initiatives simultaneously including any resulting complexity, employee attrition or diversion of resources;

- future divestitures and the impact thereof on, and future acquisitions, new licenses and joint ventures and the integration thereof with the Company’s business, operations, systems, financial data and culture and the ability to realize synergies, avoid future supply chain and other business disruptions, reduce costs (including through its cash efficiency initiatives), avoid liabilities and realize potential efficiencies and benefits (including through its restructuring initiatives) at the levels and at the costs and within the time frames contemplated or at all;

- increased competition, consolidation among retailers, shifts in consumers’ preferred distribution and marketing channels (including to digital and luxury channels), distribution and shelf-space resets or reductions, compression of go-to-market cycles, changes in product and marketing requirements by retailers, reductions in retailer inventory levels and order lead-times or changes in purchasing patterns, impact from the recent Coronavirus epidemic in China on retail revenues and other changes in the retail, e-commerce and wholesale environment in which the Company does business and sells its products and the Company’s ability to respond to such changes;

- the Company and its joint ventures’, business partners’ and licensors’ abilities to obtain, maintain and protect the intellectual property used in its and their respective businesses, protect its and their respective reputations (including those of its and their executives or influencers), public goodwill, and defend claims by third parties for infringement of intellectual property rights;

- any change to the Company’s capital allocation and/or cash management priorities, including any change in the Company’s stock dividend reinvestment program and policy;

- any unanticipated problems, liabilities or other challenges associated with an acquired business, joint ventures or strategic partnerships which could result in increased risk or new, unanticipated or unknown liabilities, including with respect to environmental, competition and other regulatory, compliance or legal matters;

- the Company’s international operations and joint ventures, including enforceability and effectiveness of its joint venture agreements and reputational, compliance, regulatory, economic and foreign political risks, including difficulties and costs associated with maintaining compliance with a broad variety of complex local and international regulations;

- the Company's dependence on certain licenses (especially in its Luxury division) and the Company's ability to renew expiring licenses on favorable terms or at all;

- the Company's dependence on entities performing outsourced functions, including outsourcing of distribution functions, and third-party manufacturers, logistics and supply chain suppliers, and other suppliers, including third-party software providers;

- administrative, product development and other difficulties in meeting the expected timing of market expansions, product launches and marketing efforts;

- global political and/or economic uncertainties, disruptions or major regulatory or policy changes, and/or the enforcement thereof that affect the Company’s business, financial performance, operations or products, including the impact of Brexit (and business or market disruption arising from a "hard Brexit"), the current U.S. administration, changes in the U.S. tax code, and recent changes and future changes in tariffs, retaliatory or trade protection measures, trade policies and other international trade regulations in the U.S., the European Union and Asia and in other regions where the Company operates;

- currency exchange rate volatility and currency devaluation;

- the number, type, outcomes (by judgment, order or settlement) and costs of current or future legal, compliance, tax, regulatory or administrative proceedings, investigations and/or litigation, including litigation relating to the tender offer by Cottage Holdco B.V. (the “Cottage Tender Offer”);

- the Company’s ability to manage seasonal factors and other variability and to anticipate future business trends and needs;

- disruptions in operations, sales and in other areas, including due to disruptions in our supply chain, restructurings and other business alignment activities, the move of the Company’s headquarters to Amsterdam, implementation of the Strategic Review, manufacturing or information technology systems, labor disputes, extreme weather and natural disasters, impact from the recent Coronavirus epidemic in China and the impact of such disruptions on the Company’s ability to generate profits, stabilize or grow revenues or cash flows, comply with its contractual obligations and accurately forecast demand and supply needs and/or future results;

- restrictions imposed on the Company through its license agreements, credit facilities and senior unsecured bonds or other material contracts, its ability to generate cash flow to repay, refinance or recapitalize debt and otherwise comply with its debt instruments, and changes in the manner in which the Company finances its debt and future capital needs;

- increasing dependency on information technology and the Company’s ability to protect against service interruptions, data corruption, cyber-based attacks or network security breaches, costs and timing of implementation and effectiveness of any upgrades or other changes to information technology systems, and the cost of compliance or the Company’s failure to comply with any privacy or data security laws (including the European Union General Data Protection Regulation and the California Consumer Privacy Act) or to protect against theft of customer, employee and corporate sensitive information;

- the Company's ability to attract and retain key personnel and the impact of senior management transitions and organizational structure changes, including the co-location of key business leaders and functions in Amsterdam;

- the distribution and sale by third parties of counterfeit and/or gray market versions of the Company’s products; and

- the impact of the Cottage Tender Offer and of the Turnaround Plan, and the Strategic Review and any related transactions, on the Company’s relationships with key customers and suppliers and certain material contracts;

- the Company’s relationship with Cottage Holdco B.V., as the Company’s majority stockholder, and its affiliates, and any related conflicts of interest or litigation;

- future sales of a significant number of shares in the public market by the Company's majority stockholder or contractually by certain commercial banks on behalf of the Company's majority stockholder, as may be required to satisfy obligations under and any potential future credit difficulties in connection with such majority stockholder's credit agreement, or the perception that such sales could occur; and

- other factors described elsewhere in this document and in documents that the Company files with the SEC from time to time.

When used herein, the term “includes” and “including” means, unless the context otherwise indicates, “including without limitation”. More information about potential risks and uncertainties that could affect the Company’s business and financial results is included under the heading “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2019 and other periodic reports the Company has filed and may file with the SEC from time to time.

All forward-looking statements made in this release are qualified by these cautionary statements. These forward-looking statements are made only as of the date of this release, and the Company does not undertake any obligation, other than as may be required by applicable law, to update or revise any forward-looking or cautionary statements to reflect changes in assumptions, the occurrence of events, unanticipated or otherwise, or changes in future operating results over time or otherwise.

Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance unless expressed as such, and should only be viewed as historical data.

Non-GAAP Financial Measures

The Company operates on a global basis, with the majority of net revenues generated outside of the U.S. Accordingly, fluctuations in foreign currency exchange rates can affect results of operations. Therefore, to supplement financial results presented in accordance with GAAP, certain financial information is presented excluding the impact of foreign currency exchange translations to provide a framework for assessing how the underlying businesses performed excluding the impact of foreign currency exchange translations (“constant currency”). Constant currency information compares results between periods as if exchange rates had remained constant period-over-period, with the current period’s results calculated at the prior-year period’s rates. The Company calculates constant currency information by translating current and prior-period results for entities reporting in currencies other than U.S. dollars into U.S. dollars using constant foreign currency exchange rates. The constant currency calculations do not adjust for the impact of revaluing specific transactions denominated in a currency that is different to the functional currency of that entity when exchange rates fluctuate. The constant currency information presented may not be comparable to similarly titled measures reported by other companies. The Company discloses the following constant currency financial measures: net revenues, organic like-for-like (LFL) net revenues, adjusted gross profit and adjusted operating income.

The Company presents period-over-period comparisons of net revenues on a constant currency basis as well as on an organic (LFL) basis. The Company believes that organic (LFL) better enables management and investors to analyze and compare the Company's net revenues performance from period to period. For the periods described in this release, the term “like-for-like” describes the Company's core operating performance, excluding the financial impact of (i) acquired brands or businesses in the current year period until we have twelve months of comparable financial results, (ii) the divested brands or businesses or early terminated brands, generally, in the prior year non-comparable periods, to maintain comparable financial results with the current fiscal year period and (iii) foreign currency exchange translations to the extent applicable. For a reconciliation of organic (LFL) period-over-period, see the table entitled “Reconciliation of Reported Net Revenues to Like-For-Like Net Revenues”.

The Company presents operating income, operating income margin, gross profit, gross margin, effective tax rate, net income, net income margin, net revenues and EPS (diluted) on a non-GAAP basis and specifies that these measures are non-GAAP by using the term “adjusted”. The Company believes these non-GAAP financial measures better enable management and investors to analyze and compare operating performance from period to period. In calculating adjusted operating income, operating income margin, gross profit, gross margin, effective tax rate, net income, net income margin and EPS (diluted), the Company excludes the following items:

- Costs related to acquisition and divestiture activities: The Company excludes acquisition-related costs and acquisition accounting impacts such as those related to transaction costs and costs associated with the revaluation of acquired inventory in connection with business combinations because these costs are unique to each transaction. The nature and amount of such costs vary significantly based on the size and timing of the acquisitions and the maturities of the businesses being acquired. Also, the size, complexity and/or volume of past acquisitions, which often drives the magnitude of such expenses, may not be indicative of the size, complexity and/or volume of any future acquisitions.

- Restructuring and other business realignment costs: The Company excludes costs associated with restructuring and business structure realignment programs to allow for comparable financial results to historical operations and forward-looking guidance. In addition, the nature and amount of such charges vary significantly based on the size and timing of the programs. By excluding the above referenced expenses from the non-GAAP financial measures, management is able to evaluate the Company’s ability to utilize existing assets and estimate their long-term value. Furthermore, management believes that the adjustment of these items supplement the GAAP information with a measure that can be used to assess the sustainability of the Company’s operating performance.

- Asset impairment charges: The Company excludes the impact of asset impairments as such non-cash amounts are inconsistent in amount and frequency and are significantly impacted by the timing and/or size of acquisitions. Our management believes that the adjustment of these items supplement the GAAP information with a measure that can be used to assess the sustainability of our operating performance.

- Gain on sale of business: The Company excludes the impact of the Gain on sale of business as such amounts are inconsistent in amount and frequency and are significantly impacted by the size of divestitures. Our management believes that the adjustment of these items supplements the GAAP information with a measure that can be used to assess the sustainability of our operating performance.

- Amortization expense: The Company excludes the impact of amortization of finite-lived intangible assets, as such non-cash amounts are inconsistent in amount and frequency and are significantly impacted by the timing and/or size of acquisitions. Management believes that the adjustment of these items supplement the GAAP information with a measure that can be used to assess the sustainability of the Company’s operating performance. Although the Company excludes amortization of intangible assets from the non-GAAP expenses, management believes that it is important for investors to understand that such intangible assets contribute to revenue generation. Amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Any future acquisitions may result in the amortization of additional intangible assets.

- Other expense: The Company excludes the impact of costs incurred for legal and advisory services rendered in connection with the evaluation of the tender offer initiated by certain of our shareholders. Our management believes these costs do not reflect our underlying ongoing business, and the adjustment of such costs helps investors and others compare and analyze performance from period to period. We have also excluded the impact of pension curtailment (gains) and losses and pension settlements as such events are triggered by our restructuring and other business realignment activities and the amount of such charges vary significantly based on the size and timing of the programs.

- Noncontrolling interest: This adjustment represents the after-tax impact of the non-GAAP adjustments included in Net income attributable to noncontrolling interests based on the relevant non-controlling interest percentage.

- Tax: This adjustment represents the impact of the tax effect of the pretax items excluded from Adjusted net income. The tax impact of the non-GAAP adjustments is based on the tax rates related to the jurisdiction in which the adjusted items are received or incurred.

The estimated supply chain impact to adjusted operating income in the prior year only includes the direct impact on net revenues and the associated impact on cost of sales, while the Company assumed no impact from any other operating expenses.

The Company has provided a quantitative reconciliation of the difference between the non-GAAP financial measures and the financial measures calculated and reported in accordance with GAAP. For a reconciliation of adjusted gross profit to gross profit, adjusted EPS (diluted) to EPS (diluted), and adjusted net revenues to net revenues, see the table entitled “Reconciliation of Reported to Adjusted Results for the Consolidated Statements of Operations.” For a reconciliation of adjusted operating income to operating income and adjusted operating income margin to operating income margin, see the tables entitled “Reconciliation of Reported Operating Income (Loss) to Adjusted Operating Income” and "Reconciliation of Reported Operating Income (Loss) to Adjusted Operating Income by Segment." For a reconciliation of adjusted effective tax rate to effective tax rate, see the table entitled “Reconciliation of Reported Income (Loss) Before Income Taxes and Effective Tax Rates to Adjusted Income Before Income Taxes and Adjusted Effective Tax Rates.” For a reconciliation of adjusted net income and adjusted net income margin to net income (loss), see the table entitled

“Reconciliation of Reported Net Income (Loss) to Adjusted Net Income.”

The Company also presents free cash flow, adjusted earnings before interest, taxes, depreciation and amortization ("EBITDA") and net debt. Management believes that these measures are useful for investors because it provides them with an important perspective on the cash available for debt repayment and other strategic measures and provides them with the same measures that management uses as the basis for making resource allocation decisions. Free cash flow is defined as net cash provided by operating activities, less capital expenditures, adjusted EBITDA is defined as adjusted operating income less depreciation and net debt is defined as total debt less cash and cash equivalents. For a reconciliation of Free Cash Flow, see the table entitled “Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow,” for adjusted EBITDA, see the table entitled “Reconciliation of Adjusted Operating Income to Adjusted EBITDA” and for net debt, see the table entitled “Reconciliation of Total Debt to Net Debt.”

These non-GAAP measures should not be considered in isolation, or as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

To the extent that the Company provides guidance, it does so only on a non-GAAP basis and does not provide reconciliations of such forward-looking non-GAAP measures to GAAP due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation, including adjustments that could be made for restructuring, integration and acquisition-related expenses, amortization expenses, adjustments to inventory, and other charges reflected in our reconciliation of historic numbers, the amount of which, based on historical experience, could be significant.

COTY INC. Supplemental Schedules Including NON-GAAP Financial Measures

Click here for Additional Tables.

For more information contact :

Investor Relations

Olga Levinzon, +1 212 389-7733

Media Relations

Lisa Kessler, +917 - 348 - 3373

Arnaud Leblin, + 33 1 58 71 72 00