A stronger Coty emerging in Q1

SHARE WITH :

Financial IMAGES

NEW YORK - November 6, 2020-- Coty Inc. (NYSE: COTY) today announced significantly improved financial results for the first quarter of fiscal year 2021, ended September 30, 2020.

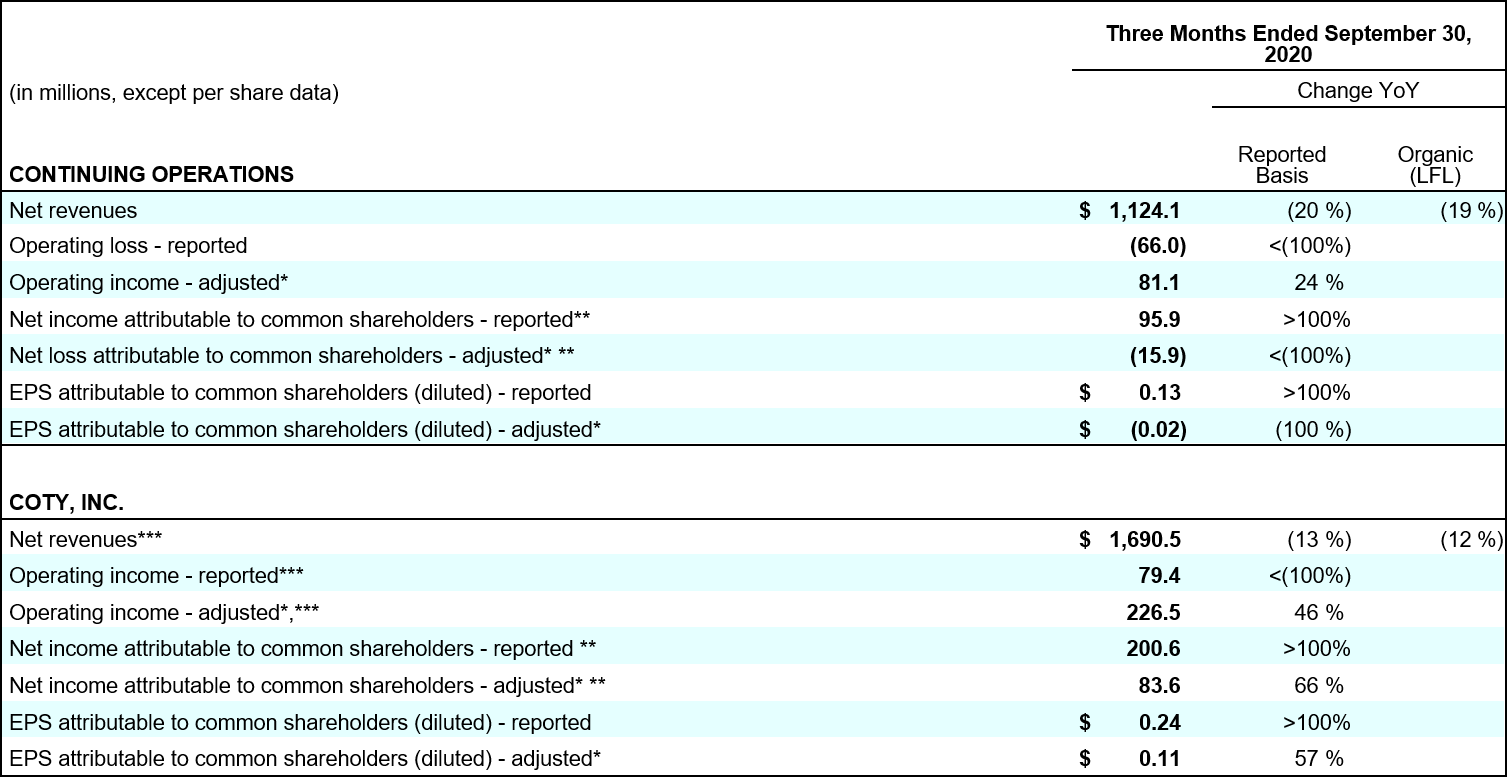

Since the previous quarter, net revenues improved each month, resulting in a 19% LFL decline for Coty's Continuing Operations, an improvement of over 40 percentage points as compared to the change in net revenues from Continuing Operations in the previous quarter. Fixed costs savings were approximately $80 million in 1Q21, and are on track to deliver over $200 million of savings in FY21, while still maintaining focused marketing investments. The operational improvements and stringent cost controls resulted in $81.1 million in adjusted operating income from Continuing Operations, an increase of 24% versus last year. Total Coty adjusted EPS, which includes Wella, grew 57% to $0.11 for the quarter, while reported EPS was $0.24.

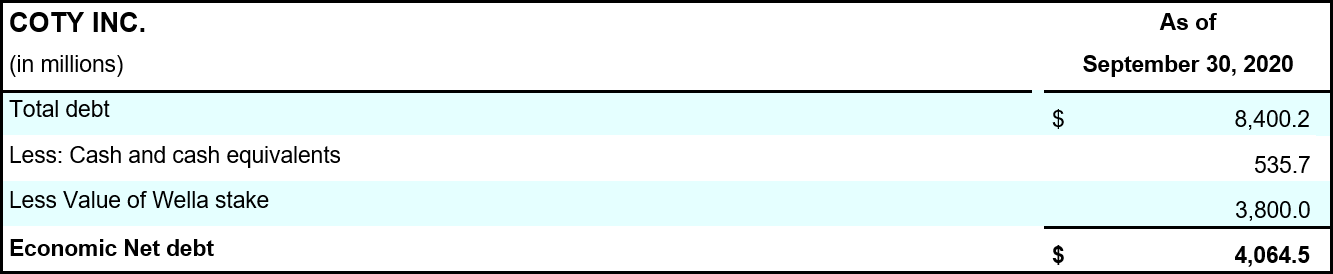

The Wella divestiture is expected to close as planned by the end of CY20, which - together with positive cash flow in 2Q21 - will lower the Financial Net Debt from $7.9 billion today to around $5.0 billion. Taking into account the retained 40% Wella stake (worth $1.3 billion), the Economic Net Debt will stand below $4.0 billion.

Against this backdrop, Coty has made substantive progress on its key priorities including innovation and performance in both prestige and mass channels, strengthened positioning in its core markets, stronger e-commerce momentum and presence, and growth from its footholds in both skincare and in China. With its early progress, Coty is strengthening its brands and reinforcing their connection with consumers around the world.

Commenting on the operating results, Sue Y. Nabi, Coty's CEO, said:

"Our first quarter results are a testament that a stronger, more focused and more flexible Coty, is emerging in the middle of the COVID-19 pandemic and better prepared to face any future market disruptions. Impressively, the organization has continued to adapt to the new normal, executing on our financial and operational priorities, including profit and cash flow protection, strong innovation performance, e-commerce momentum, and strengthened positioning in core markets.

Our results met or exceeded our expectations by all measures, showing significant improvement from 4Q20 across all of our regions, and across our prestige and mass businesses. Our stringent cost control enabled over 20% growth in our adjusted operating income and over 50% growth of the total company EPS.

The success of our recent launches, including Marc Jacobs Perfect, Gucci's Bloom Profumo di Fiori, Sally Hansen's good.kind.pure, and CoverGirl's Clean Fresh, confirm the strength and enduring potential of our brand portfolio. As we have leaned into our digital efforts and activation, we have seen double-to-triple digit e-commerce sell-out growth across most markets, with our e-commerce penetration as a percentage of our overall sales doubling to 13%. As a result, we have strengthened our positions in our core markets, gaining market share in prestige fragrances across the U.S., U.K, and Germany, and stabilizing our mass color cosmetics market share in the U.S. These milestones, along with the strengthening of our executive leadership team with Isabelle Bonfanti as Chief Commercial Officer of Luxury and Jean-Denis Mariani as Chief Digital Officer, put us well on the path to the new, future Coty.

We remain focused on diligent cost control and delivering on our FY21 financial commitments, including being profitable on an adjusted operating income basis for Continuing Operations and being cash positive for the year, supporting improved like-for-like Financial Net Debt.

More than ever, Coty is committed to reigniting our mass color cosmetics business, especially CoverGirl. Likewise, we will accelerate Coty's prestige business growth through makeup by leveraging our designer brands portfolio, including Gucci and Burberry, especially in Asia. We will continue building further growth engines, leveraging the potential of our skincare brands powered by our new DTC capabilities, starting with Kylie skincare.

After several months in the CEO role, I am as convinced as ever that we've put in place the right foundations to unleash Coty's huge potential. Coty is now ready to grow in all core regions, categories and price positions across the market."

Highlights

- Improving sales trends across all core regions and channels, driven by innovation product launches and e-commerce momentum

- 1Q21 Continuing Operations net revenues, which exclude Wella, declined 20% as reported and 19% LFL, with further sales trend improvement in October

- Continuing Operations reported operating loss of $66.0 million

- Strong growth in 1Q21 Continuing Operations adjusted operating income of $81.1 million, up 24%

- Good progress with approximately $80 million fixed cost reductions and very focused marketing investments; on-track to deliver over $200 million of cost savings in FY21

- 1Q21 free cash outflow of $28.3 million was ahead of internal expectations, despite the impact of delayed payments from 4Q20, fueled by profit growth and strong efforts on overdues collection

- Financial Net Debt stable at $7,864.5 million. Wella proceeds and residual value of Wella stake to underpin expected Economic Net Debt below $4.0 billion post closing

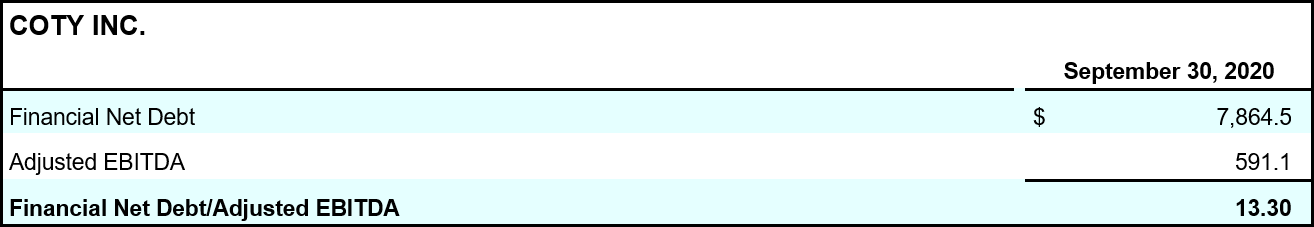

- Coty targets Financial Net Debt to EBITDA ~5x by end of Calendar 21 (3.5x Economic Net debt), with a medium term leverage target of < 3x Financial Net Debt to EBITDA

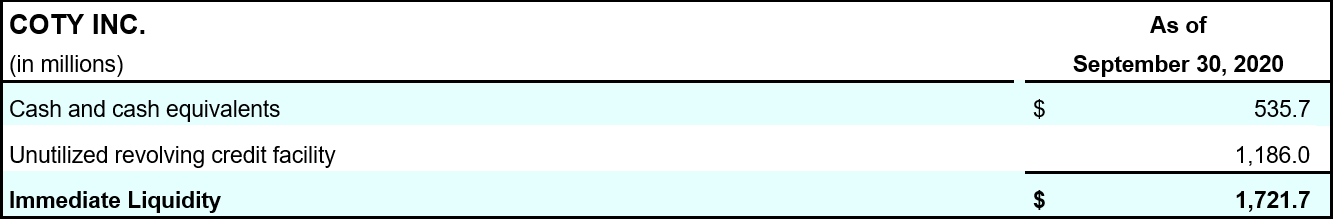

- Significant immediate liquidity of $1,721.7 million at end-quarter

Financial Results

Note: Discussions of "Total Coty" results reflect the current full scope of Coty's revenues and costs; "Continuing Operations" results reflect Total Coty results less the revenues and directly attributable costs of the soon-to-be-divested Wella business; "Ongoing Coty" results reflect Continuing Operations plus a partial cost recovery expected under the Wella transitional service agreement (the “Wella TSA”) which the Company believes is useful information to investors to analyze the balance of costs for the ongoing business.

Refer to “Non-GAAP Financial Measures” for discussion of the non-GAAP financial measures used in this release; reconciliations from reported to adjusted results can be found at the end of this release.

Total Coty

Revenues:

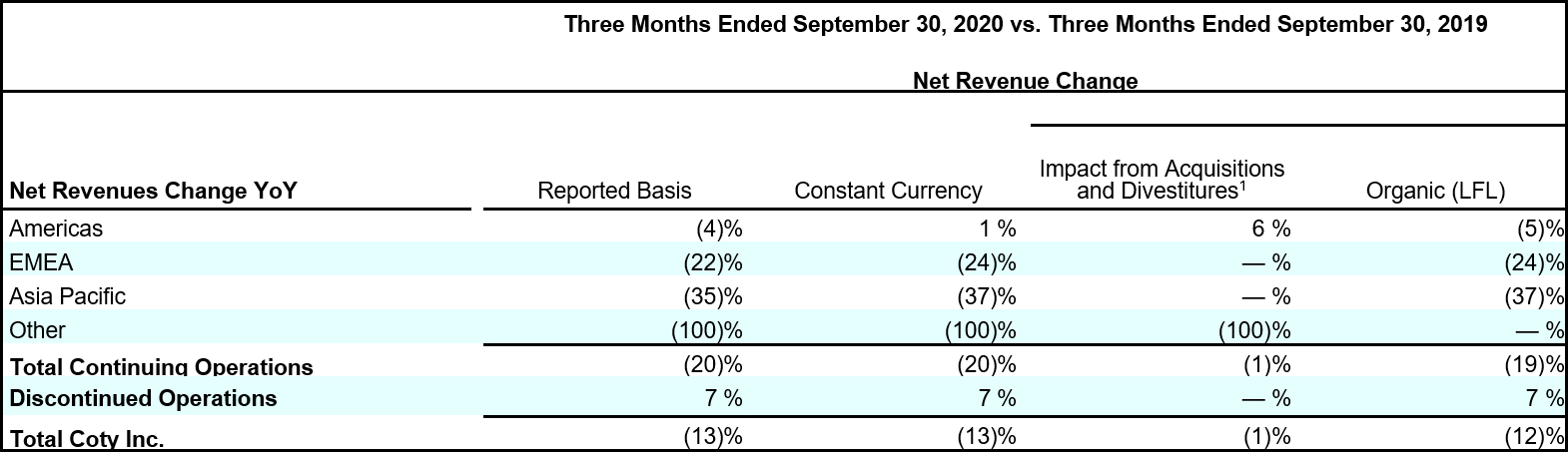

- 1Q21 reported net revenues of $1,690.5 million decreased 13.0% year-over-year, with negligible FX impact. Like-for-like (LFL) revenue decreased 11.8%, driven by LFL decreases in the Asia Pacific segment of 36.6%, EMEA of 24.4%, and Americas of 4.5%, while Wella rose 6.5%.

Gross Margin:

- 1Q21 reported and adjusted gross margin of 61.8% decreased from 62.0% in the prior-year period, primarily due to the decline in sales volume as well as mix impact, including a higher proportion of sales coming from mass brands and the Brazil market which was impacted by FX depreciation, partially offset by a higher gross margin at Wella.

Operating Income:

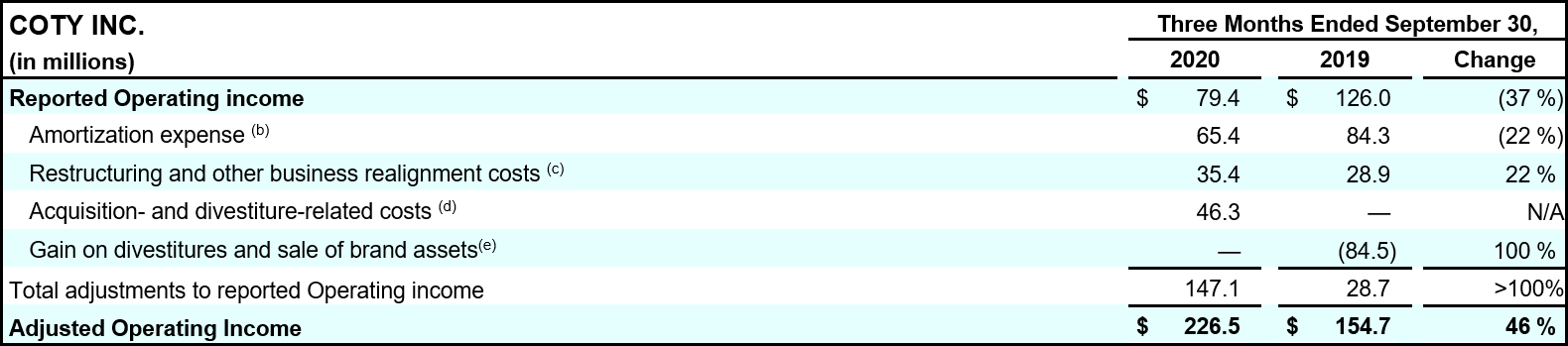

- 1Q21 reported operating income of $79.4 million declined from $126.0 million due to lower sales, reduced gross profit, as well as acquisition and divestiture related expenses of $46.3 million, and restructuring and other business realignment costs of $35.4 million. This was partially offset by lower media investments and fixed cost expenses, as well as strong operating income growth at Wella due to its increase in sales and gross margin, as well as no depreciation and amortization costs recorded for Wella as a 'held for sale' asset.

- 1Q21 adjusted operating income of $226.5 million increased 46% from $154.7 million in the prior year. The increase was driven by strong fixed cost reductions across both people and non-people costs, combined with active management of marketing investments, and the aforementioned operating income growth at Wella. For 1Q21, the adjusted operating margin increased to 13.4% from 8.0% in the prior year.

Net Income:

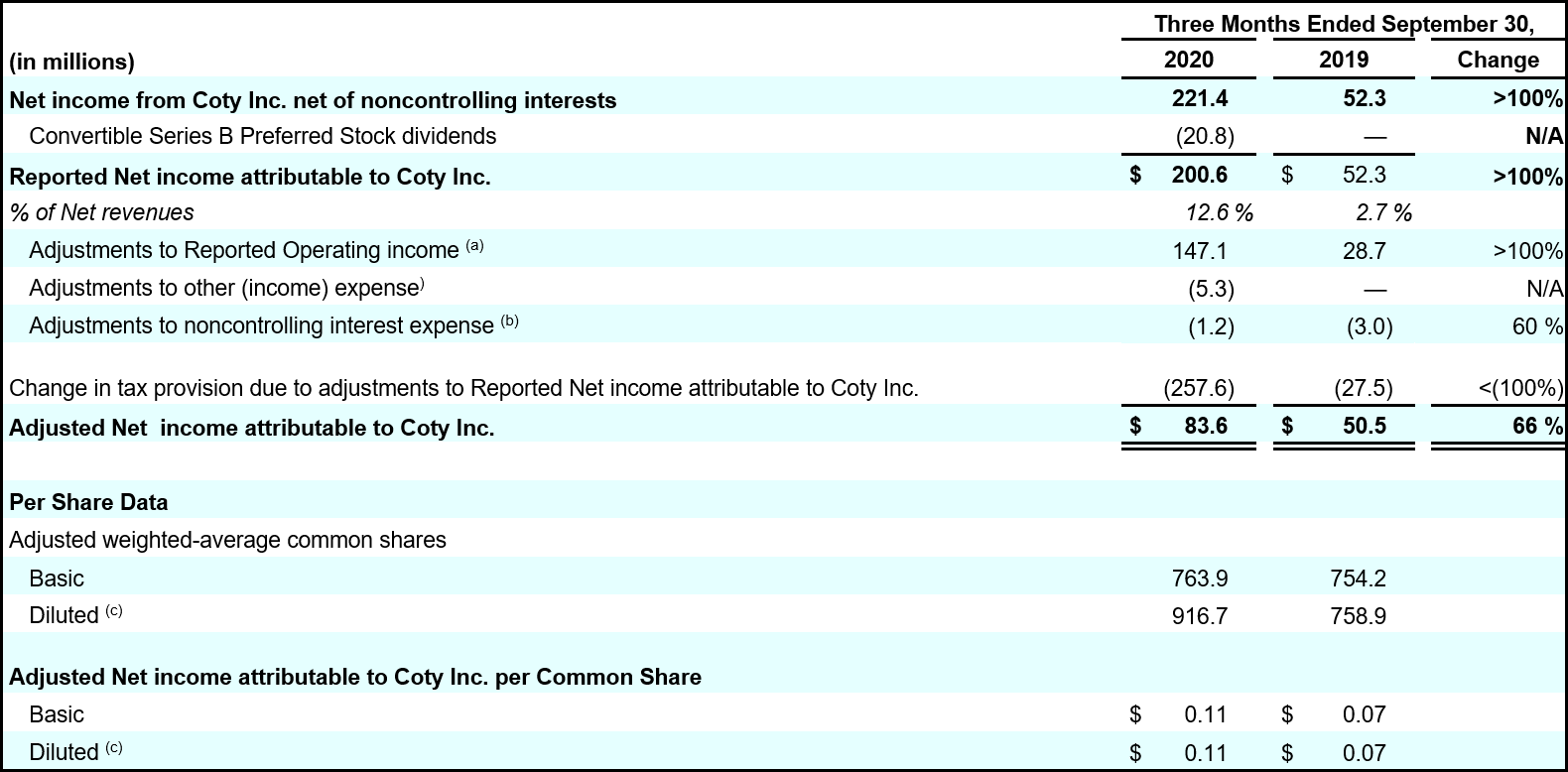

- 1Q21 reported net income of $200.6 million improved from a reported net income of $52.3 million in the prior year, aided by reported tax benefits associated with Coty's relocation of its tax principal.

- The 1Q21 adjusted net income totaled $83.6 million versus adjusted net income of $50.5 million in the prior year.

Earnings Per Share (EPS) - diluted:

- 1Q21 reported income per share of $0.26 improved from $0.07 in the prior year.

- 1Q21 adjusted EPS of $0.11 increased from $0.07 in the prior year.

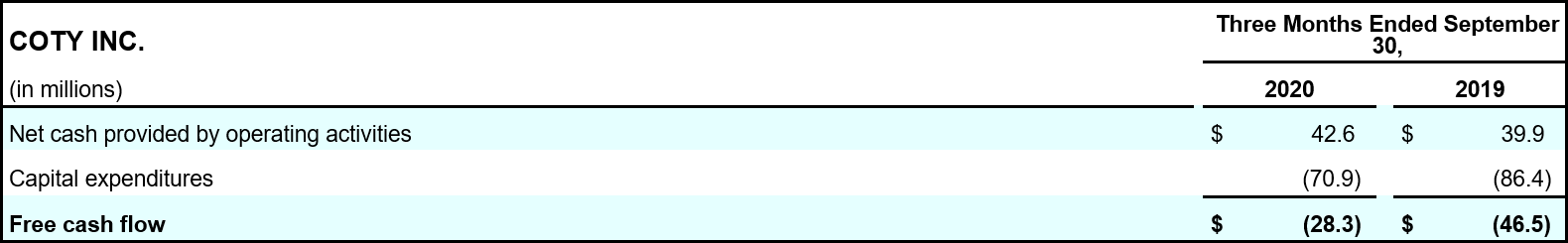

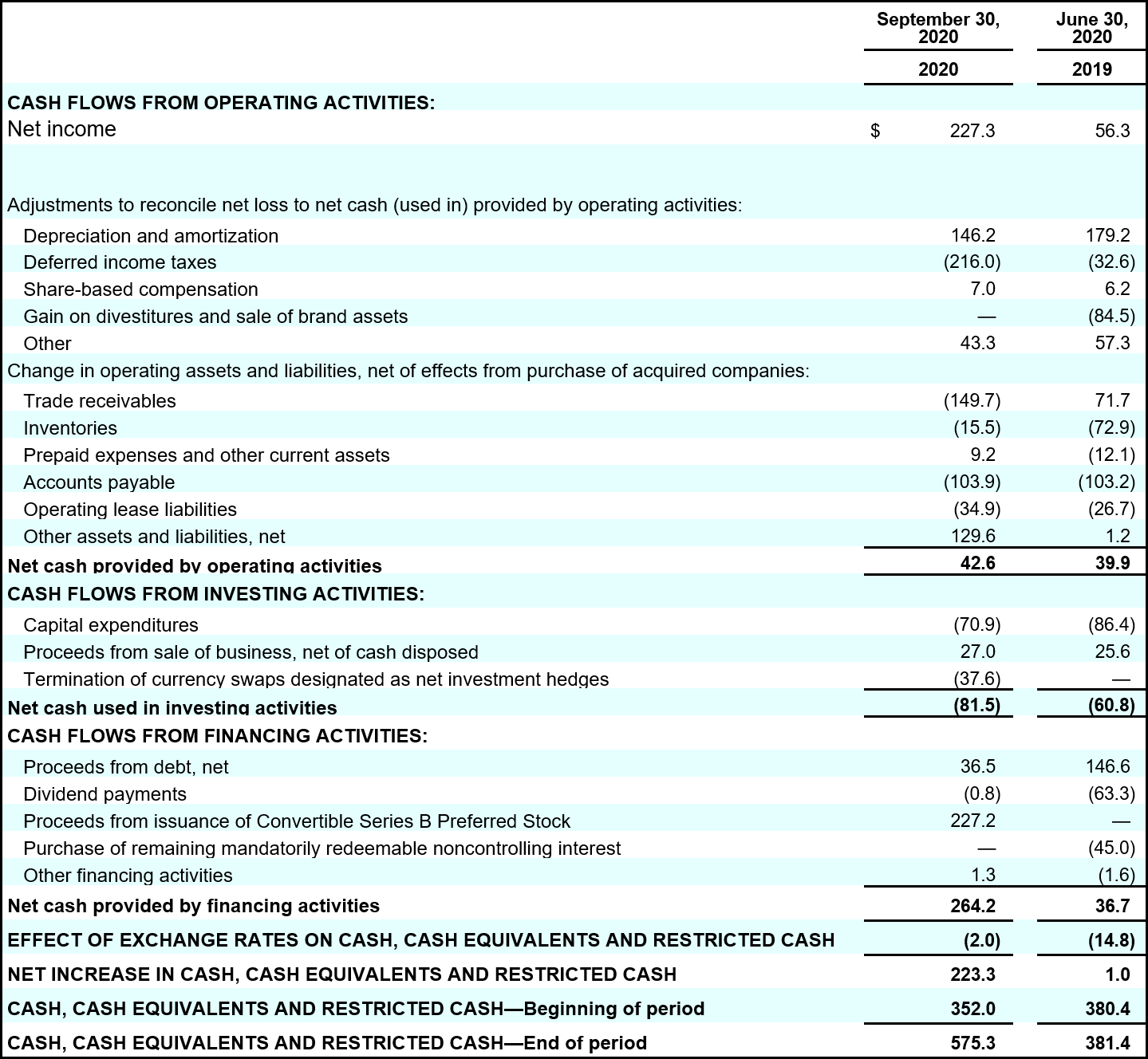

Operating Cash Flow:

- 1Q21 cash from operations totaled $42.6 million compared to $39.9 million in the prior-year period, reflecting an increase in net income on a cash basis.

- 1Q21 free cash outflow of $28.3 million declined from a free cash outflow of $46.5 million in the prior year driven by the operating cash flow increase coupled with a $15.5 million reduction in capex.

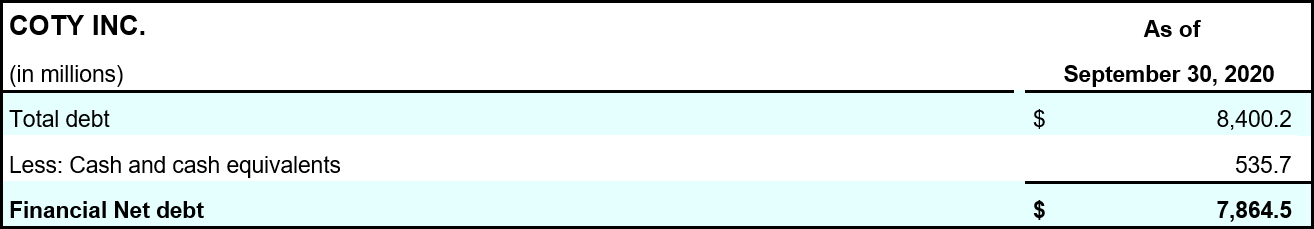

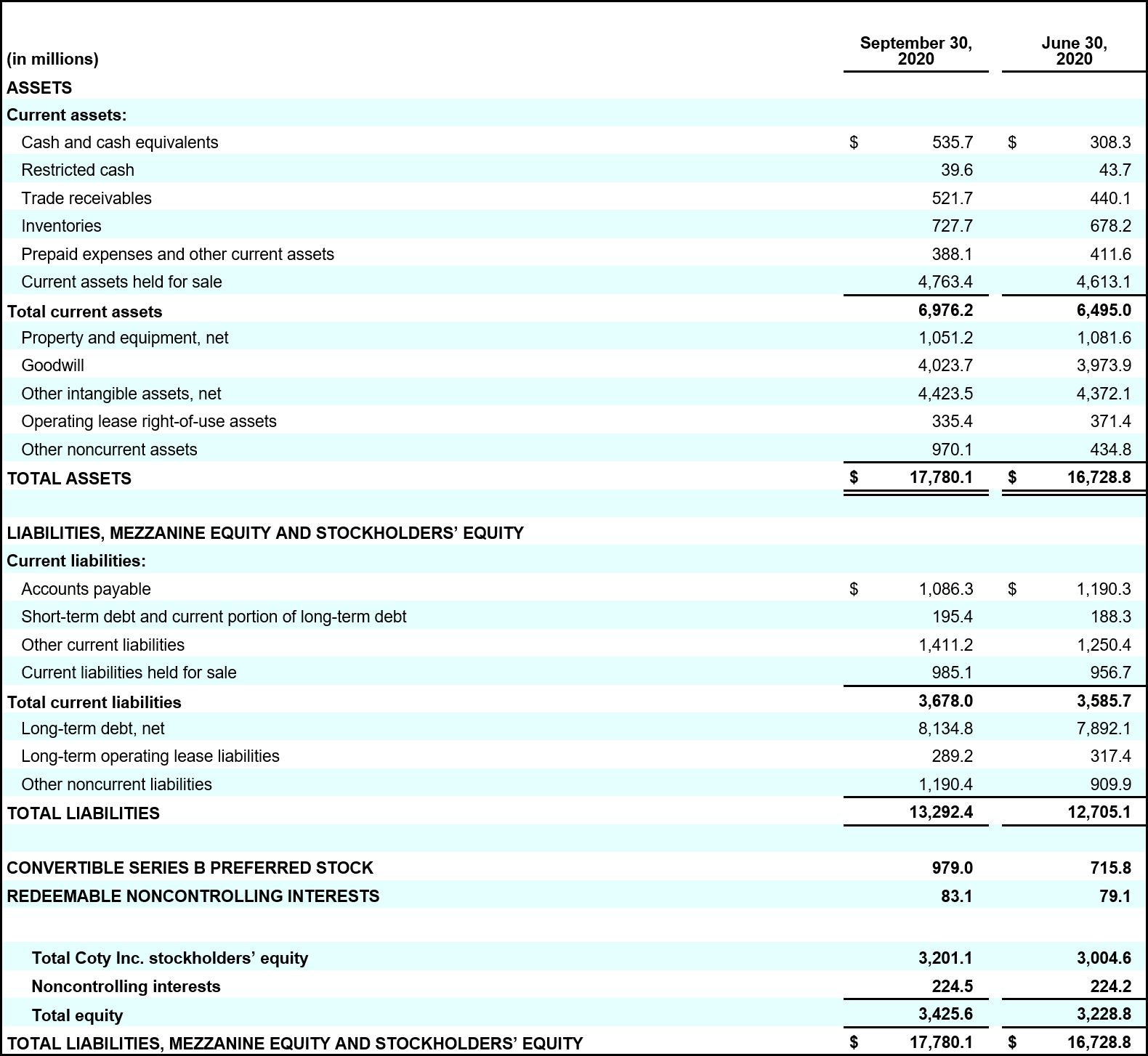

Financial Net Debt:

- Financial Net Debt of $7,864.5 million on September 30, 2020 was largely flat with the balance of $7,848.0 million on June 30, 2020.

Immediate Liquidity:

- Coty ended the year with $535.7 million in cash and cash equivalents, and immediate liquidity of $1,721.7 million.

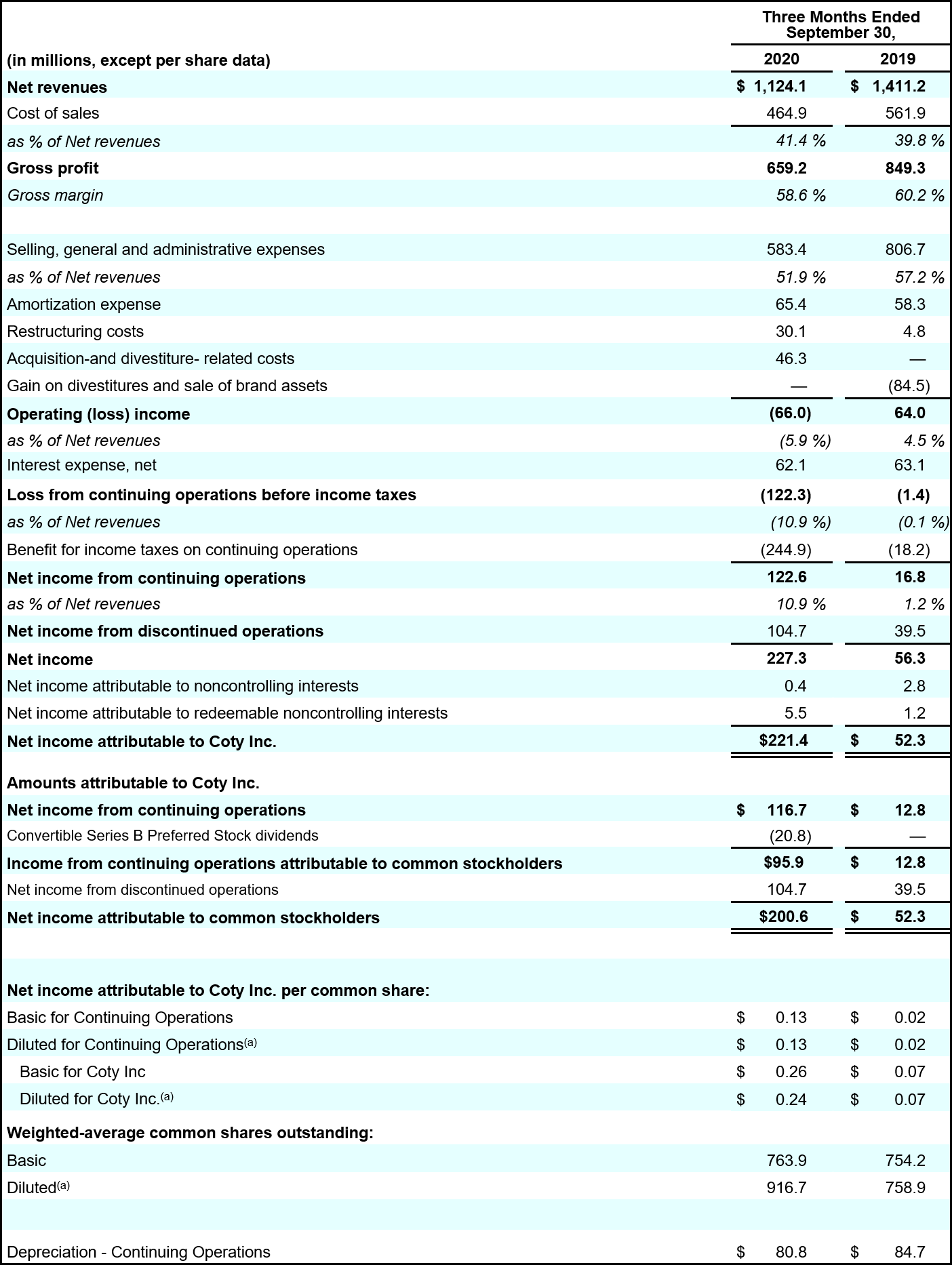

Continuing Operations

Revenues:

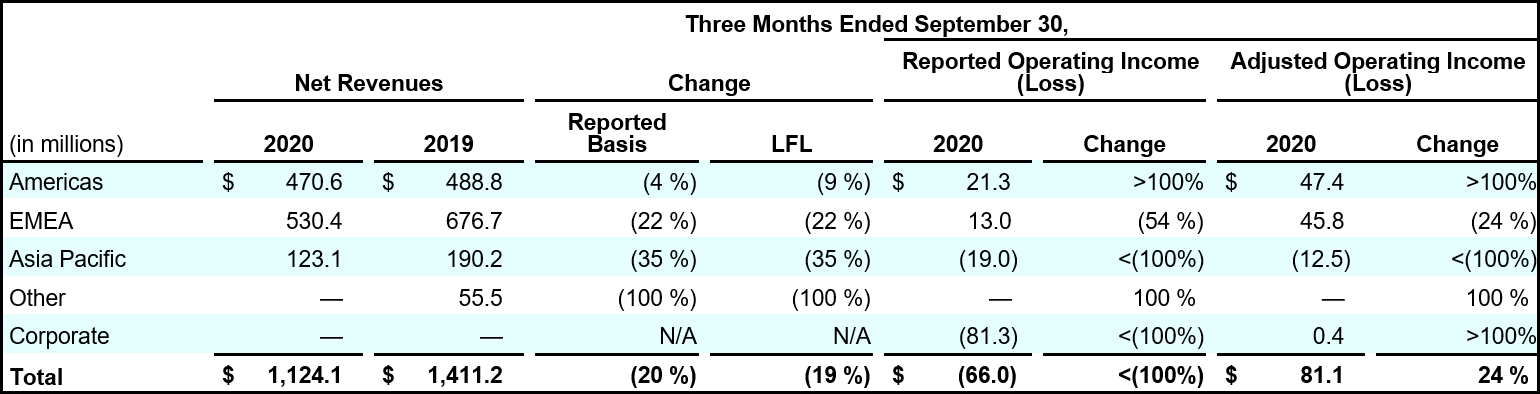

- 1Q21 reported net revenues of $1,124.1 million decreased 20.3% year-over-year, with negligible FX impact. LFL revenue decreased 18.9%, driven by LFL decreases in the Asia Pacific segment of 36.6%, EMEA of 24.4%, and Americas of 4.5%. By channel, the mass business decline moderated to 10.1% from a 48% decline in the prior quarter, and the prestige business declined 25.0%, significantly improving from -73% in the prior quarter, as stores re-opened and the industry saw better alignment between sell-in and sell-out.

Gross Margin:

- 1Q21 reported and adjusted gross margin of 58.6% decreased from 60.2% in the prior-year period, primarily due to the decline in sales volume as well as mix impact, including a higher proportion of sales coming from mass brands and the Brazil market which was impacted by FX depreciation.

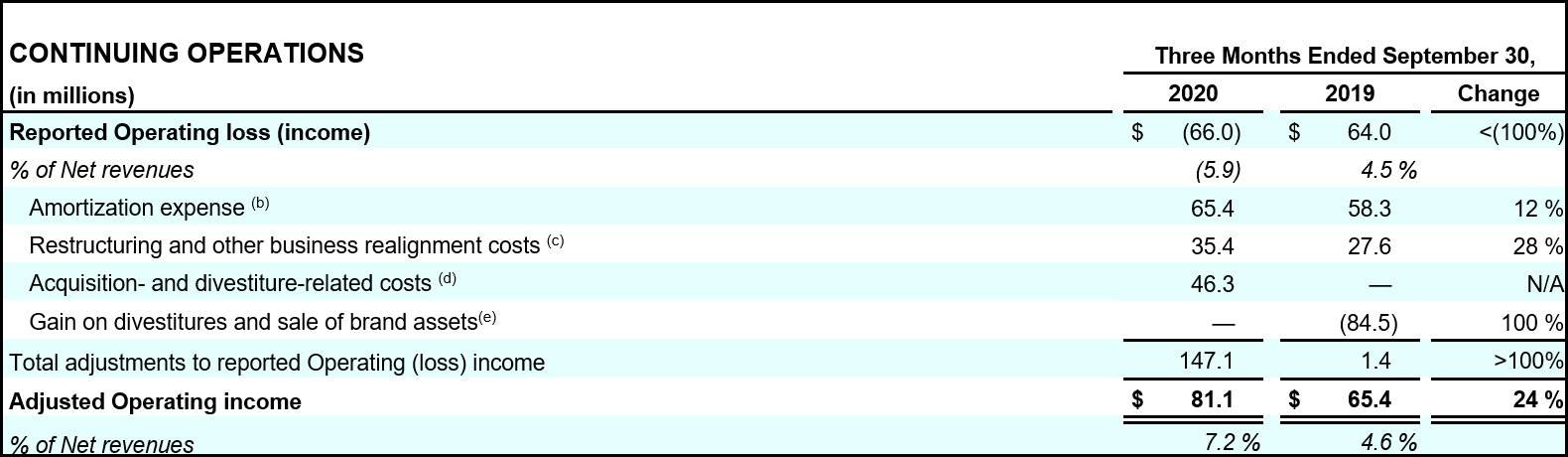

Operating Income:

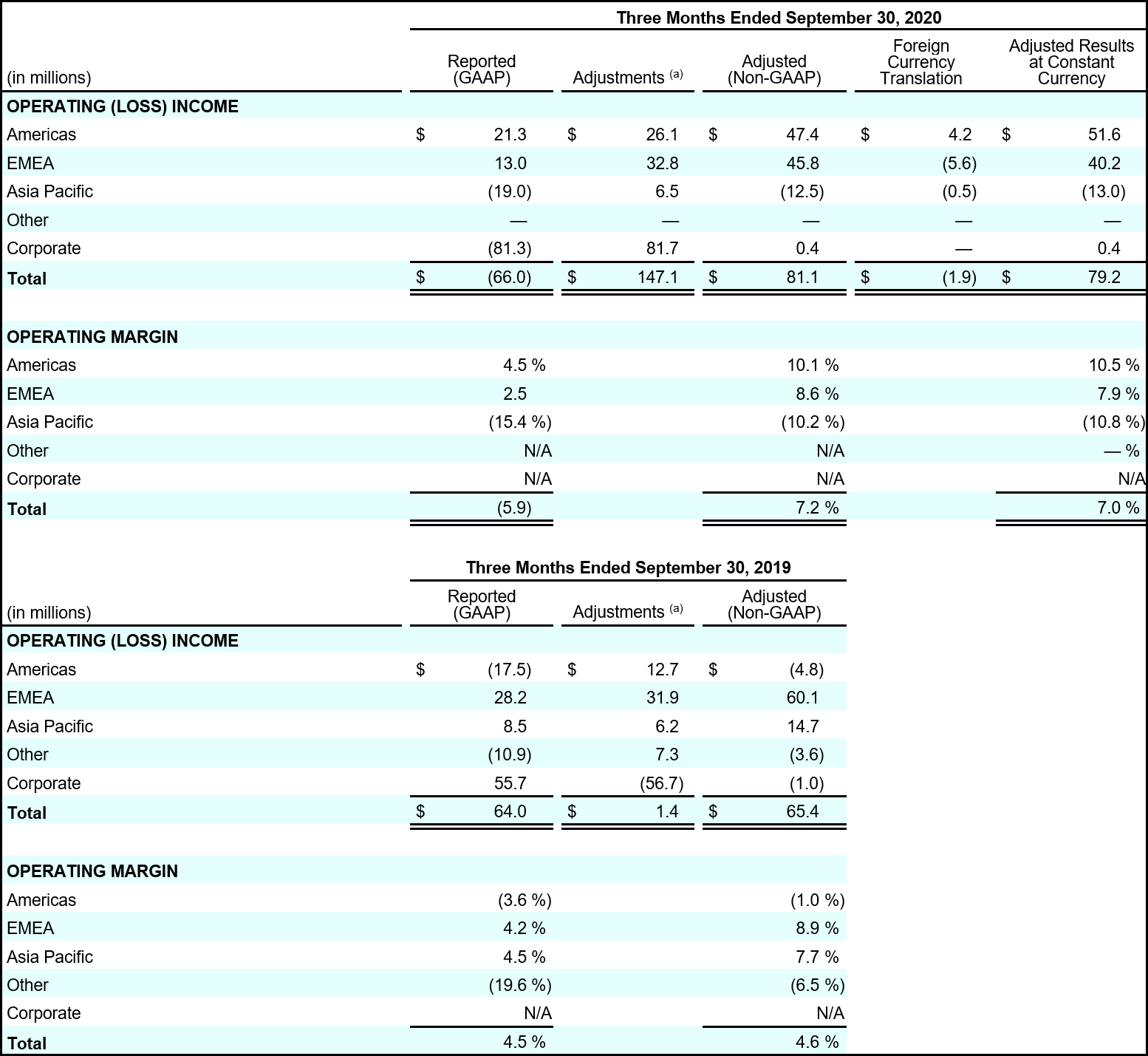

- 1Q21 reported operating loss from Continuing Operations of $66.0 million declined from reported operating income of $64.0 million due to lower sales, reduced gross profit, as well as acquisition and divestiture related expenses of $46.3 million, and restructuring and other business realignment costs of $35.4 million, partially offset by lower media investments and fixed cost expenses.

- 1Q21 adjusted operating income for Continuing Operations of $81.1 million increased 24% from $65.4 million in the prior year. The increase was driven by strong fixed cost reductions across both people and non-people costs, combined with active management of marketing investments. For 1Q21, the adjusted operating margin for Continuing Operations increased 260 bps to 7.2%, despite the overhang from stranded costs.

- Including the expected income under the Wella TSA, the 1Q21 adjusted operating income for Ongoing Coty of $93 million increased from $77 million in the prior year period.

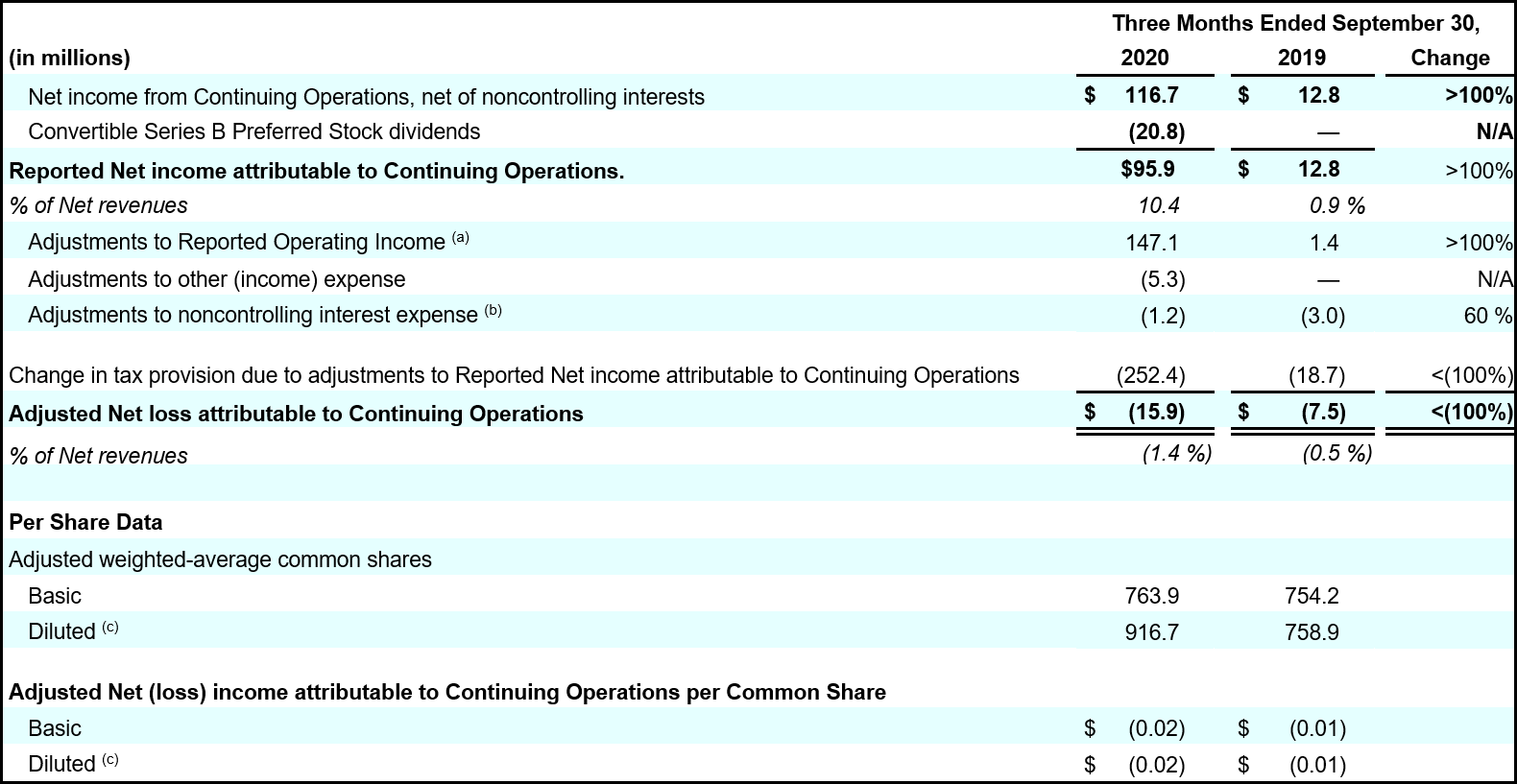

Net Income:

- 1Q21 reported net income of $116.7 million improved from $12.8 million in the prior year, aided by reported tax benefits associated with Coty's relocation of its tax principal.

- The 1Q21 adjusted net loss of $15.9 million compared to adjusted net loss of $7.5 million in the prior year period.

Earnings Per Share (EPS) - diluted:

- 1Q21 reported income per share of $0.13 improved from a reported income per share of $0.02 in the prior year.

- 1Q21 adjusted EPS of $(0.02) versus $(0.01) in the prior year.

First Quarter Business Review by Segment (Continuing Operations)

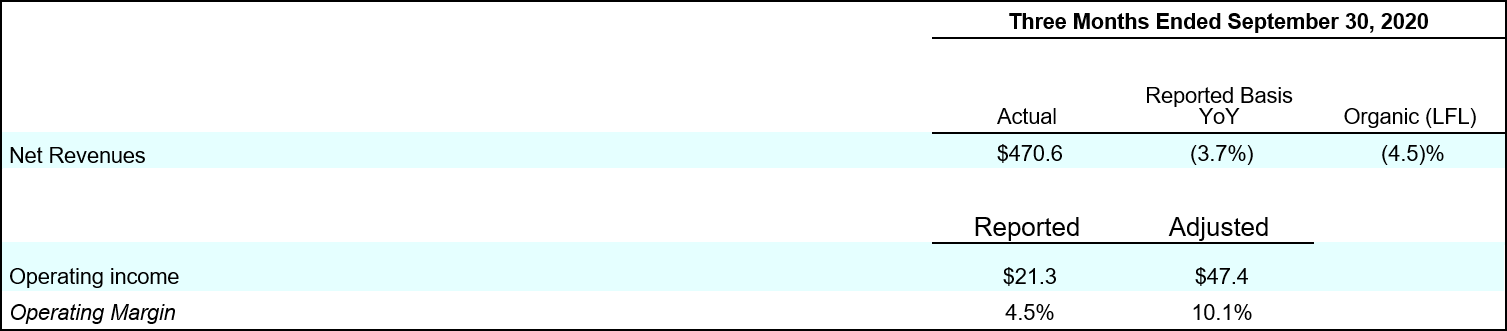

Americas

In 1Q21, Americas net revenues of $470.6 million or 42% of total Coty Continuing Operations, decreased by 3.7% versus the prior year. On a LFL basis, Americas net revenues decreased by 4.5%, showing a meaningful improvement over the prior quarter's -51.5% LFL decline, particularly within the United States which saw a slight LFL decline and Brazil which returned to growth. The improvement in 1Q21 trends was supported by a number of factors, including: 1) pent up demand driving consumption as lockdowns eased; 2) winning innovations; and 3) continued strength within e-commerce.

During the quarter, we grew market share within U.S. prestige fragrances, with Marc Jacobs, Gucci, and Burberry having particularly strong performances. Marc Jacobs Perfect has been the #1 Fall fragrance launch, helping to propel the Marc Jacobs overall brand ranking up 6 spots, from #10 to #4. Gucci saw strong sell-out across both fragrances and cosmetics, with fragrance growth fueled by Gucci Bloom Profumo in female and Gucci Guilty in male, and Gucci cosmetics maintaining momentum, becoming the #1 ranked lipstick and #3 bronzer in Sephora US and Canada in recent data. We continued to make progress in our U.S. mass beauty business, with our mass cosmetics brands maintaining stable market share in retail. This share stabilization was supported by strong growth in Sally Hansen, fueled by the leading launch of the clean nail polish line good.kind.pure and the relaunch of the Miracle Gel line, as well as the continued range expansion of the CoverGirl Clean Fresh franchise. In Brazil, our value-priced local brands were positioned well in the current market context, with strong sell-out growth across our body care brands as well as the Risque nail color brand, which strengthened its position with the launch of its Diamond Gel line.

During the quarter, e-commerce penetration as a percentage of sales in the Americas region doubled to the low teens, with e-commerce sales for both prestige and mass brands nearly doubling from the prior year period.

The reported sales for the Americas segment benefited from the contribution from the Kylie Jenner joint venture. During 1Q21, the joint venture was pressured due to reduced supply related to its cosmetics third party manufacturer. However, Kylie Skin continued to deliver very solid growth during the quarter.

The Americas segment generated a reported operating income of $21.3 million in 1Q21, compared to a reported operating loss of $17.5 million in the prior year. The 1Q21 adjusted operating income was $47.4 million, up from an adjusted operating loss of $4.8 million in the prior year, driven by close management of marketing investment and strong fixed cost reduction more than offsetting the sales decline. The adjusted operating margin was 10.1% versus (1.0)% in the prior year.

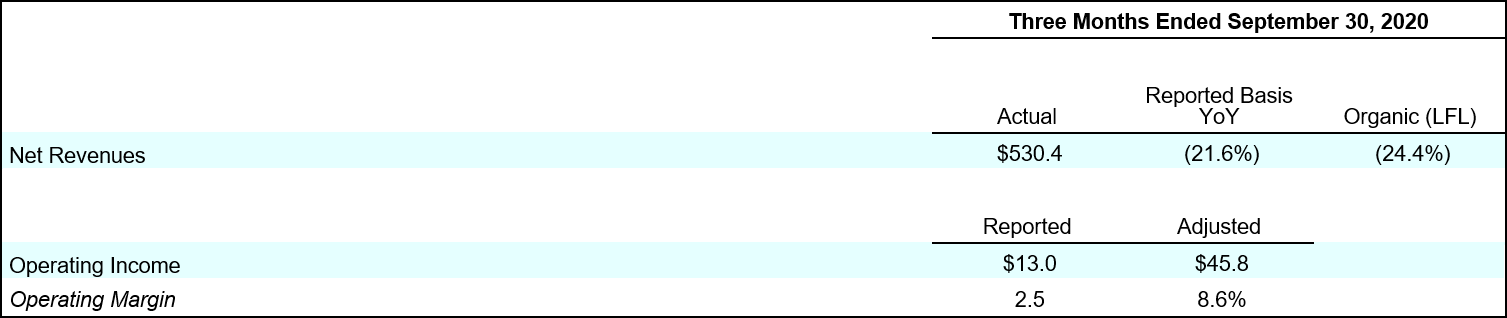

EMEA

In 1Q21, EMEA net revenues of $530.4 million, or 47% of total Coty continuing operations, declined by 21.6% versus the prior year. On a LFL basis, EMEA net revenues declined 24.4%. Sales trends in 1Q21 improved sequentially from the 67% LFL decline in 1Q20, but remained in decline due primarily to softer overall market trends in both prestige fragrances and mass cosmetics, as well as continued significant weakness in the travel retail channel.

In our prestige fragrance business, we gained market share in our core markets, Germany and the U.K., fueled by the strong performance of recent key launches including Hugo Boss Alive, Hugo Boss Bottled, Jil Sander Sun EDP and Marc Jacobs Perfect. Hugo Boss Alive, which was the #1 female launch in Germany in the spring, continued to perform well and now stands as the #8 female brand line in the market, while the men's lines were supported by the strong performance of Hugo Boss Bottled. Marc Jacobs Perfect was the #1 prestige fragrance launch in the U.K., driving strong market share growth for the overall brand. In our mass beauty business, while the cosmetics category remained pressured, we saw areas of improvement as Rimmel - U.K.'s #1 mass cosmetics brand - continued grow its leading share, and the consumer shift to at-home manicures drove market share gains for Sally Hansen across U.K., Italy, France and the Netherlands.

1Q21 e-commerce penetration as a percentage of sales in the EMEA region grew strongly to the low teens, with double digit growth in e-commerce sales for both prestige and mass brands.

Reported operating income was $13.0 million in 1Q21 versus reported operating income of $28.2 million in the prior year. The 1Q21 adjusted operating income of $45.8 million declined from $60.1 million in the prior year, driven by the lower sales, partially offset by controlled marketing spend and solid fixed cost reductions. For 1Q21, the adjusted operating margin stayed constant at 8.6%.

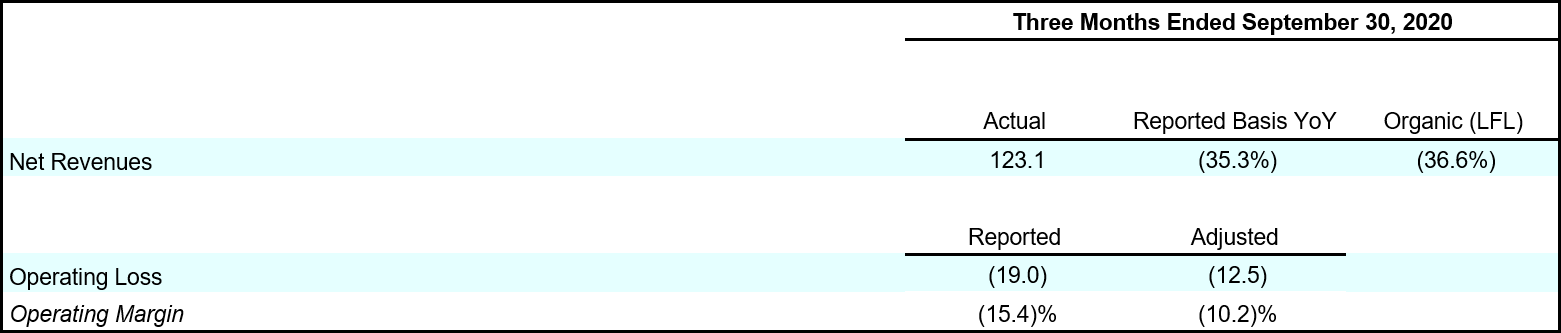

Asia Pacific

1Q21 Asia Pacific net revenues of $123.1 million, or 11% of total Coty continuing operations, decreased 35.3% on a reported basis and declined 36.6% LFL. The vast majority of the decline was driven by the continued significant pressure in the travel retail channel as well as the continued active reduction of sales to low value channels, particularly in the prestige business, which we began in 2HFY20. Encouragingly, sell-out trends for our prestige brands in the Asia Pacific region were very strong during the quarter, increasing double-digits both off-line and online. In our mass business, we gained market share in our core business in Australia, driven by Sally Hansen and CoverGirl.

China sales trends continued to improve during 1Q21, with prestige brick & mortar and e-commerce sell-out increasing in the double-digits. While China currently accounts for a low single digit percentage of Coty sales, our prestige brands have continued to strengthen their positions, with double digit growth across Gucci, Burberry, Tiffany, Miu Miu and Chloe. Within Gucci and Burberry, we have been actively expanding the brands beyond the core fragrance offerings into prestige cosmetics, with cosmetics now accounting for ~20% of sales across these two brands in China.

Reported operating loss in 1Q21 of $19.0 million declined from reported operating income of $8.5 million in the prior year. The 1Q21 adjusted operating loss of $12.5 million declined from adjusted operating income of $14.7 million in the prior year, fueled by the operating deleverage on the declining sales, partially offset by reduced fixed costs and lower marketing investments. The 1Q21 adjusted operating margin of (10.2)% declined from 7.7% in the prior year.

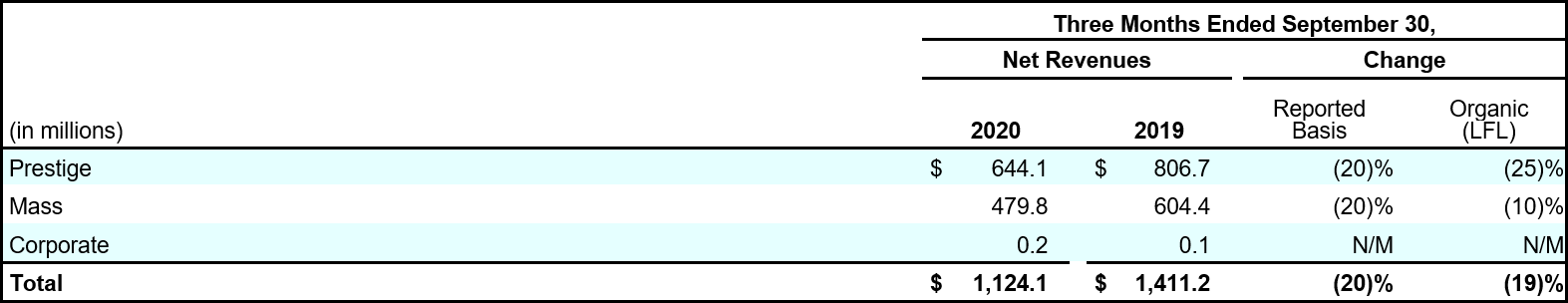

First Quarter Fiscal 2021 Business Review by Channel (Continuing Operations)

Prestige

- 1Q21 Prestige net revenues of $644.1 million, or 57.3% of Coty continuing operations, decreased 20.2% as reported and decreased 25.0% LFL, with the reported sales aided by the inclusion of Kylie Beauty sales in the current quarter. Prestige sales improved sequentially across all regions, but continued to decline as consumer traffic in stores has not returned to pre-COVID levels and the core travel retail channel remains heavily depressed, accounting for close to half of the decline in our Prestige business. Encouragingly, Prestige e-commerce sales continued to grow double digits in the quarter, and represented a high teens percentage of Prestige sales in 1Q21, double the prior year. Kylie Cosmetics sales in the quarter were pressured by reduced supply related to its cosmetics third party manufacturer, while Kylie Skincare continued to deliver strong growth, supported by the launch of the brand in Nordstrom in the U.S., Douglas across Europe, as well as by several new launches.

Mass

- 1Q21 Mass net revenues of 479.8 million, or 43% of Coty continuing operations, decreased 20.6% as reported and decreased 10.1% LFL, with the reported sales decline pressured by the inclusion of Younique revenues in the prior year period. Although sales in this channel showed sequential improvement from 4Q20, sales trends remain under pressure as mask wearing and social distancing continues to weigh on demand for color cosmetics. Encouragingly, Mass e-commerce sales continued to grow double digits in the quarter, and represented a high single digit percentage of our Mass business sales in 1Q21, double the prior year. Coty brands continued to see excellent performance on Amazon, growing market share with the e-retailer in the U.S., U.K., and Germany.

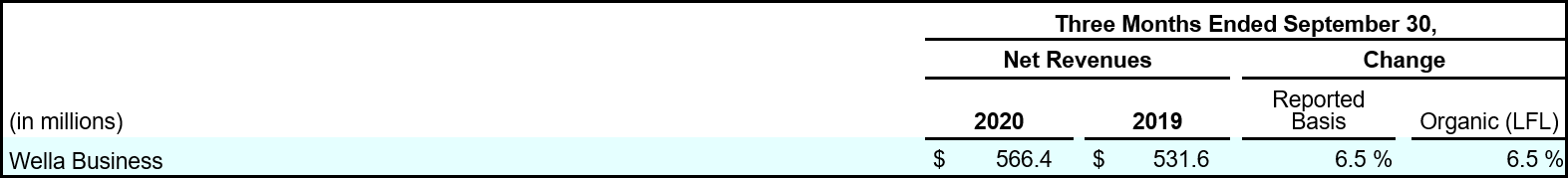

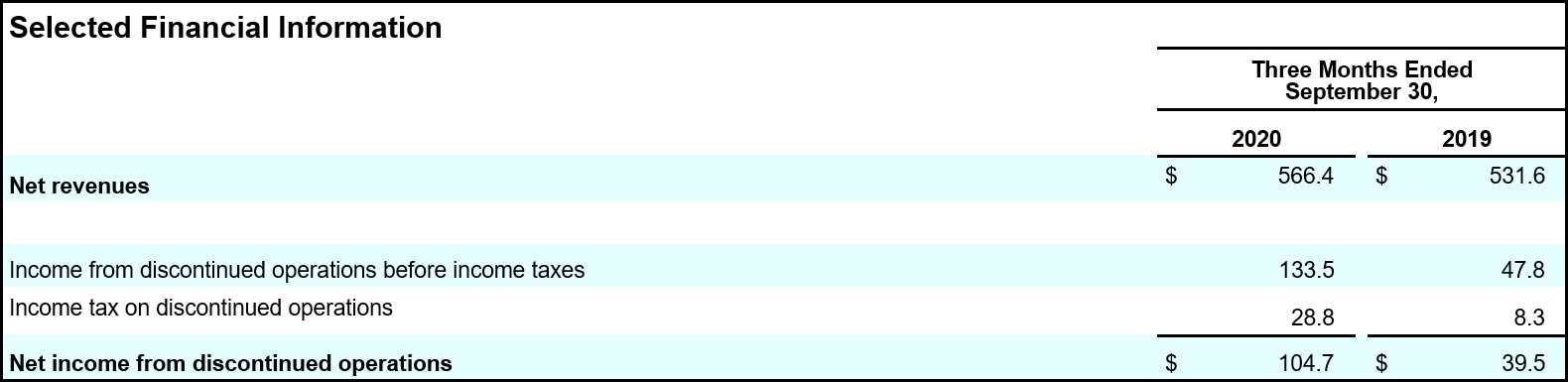

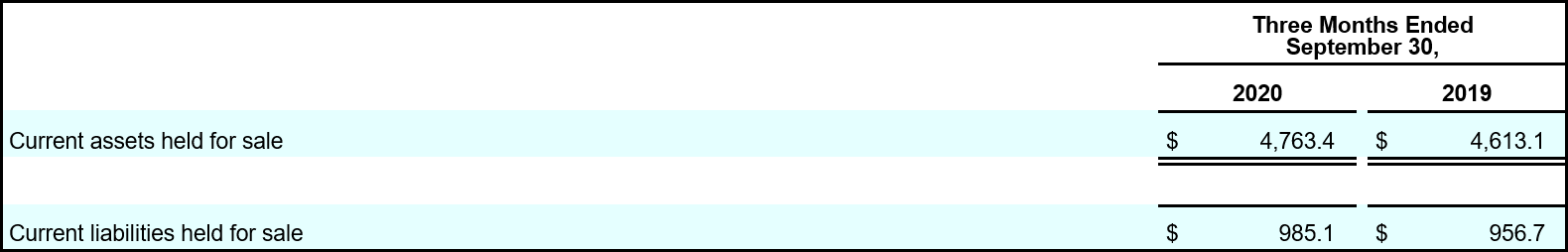

Discontinued Operations

Wella Business

- 1Q21 Wella net revenues of $566.4 million increased 6.5% as reported and increased 6.5% LFL, driven by pent up consumer demand for services following the global salon closures in 4Q20 and associated inventory replenishment for both retail and professional hair products, continued strength within retail hair, and solid e-commerce growth.

Noteworthy Company Developments

Other noteworthy company developments include:

- On September 1, 2020, Sue Y. Nabi, the highly experienced business leader and beauty entrepreneur, officially began her appointment as Chief Executive Officer of Coty.

- On October 7, 2020, Coty announced the launch of direct-to-consumer flagship websites for Kylie Skin in the United Kingdom, France, Germany, and Australia.

- On October 21, 2020, Coty announced two additions to its leadership team with the appointments of Isabelle Bonfanti as Chief Commercial Officer, Luxury, and Jean-Denis Mariani in the newly created role of Chief Digital Officer.

Conference Call

Coty Inc. will host a conference call at 8:00 a.m. (ET) today, November 6, 2020 to discuss its results. The dial-in number for the call is (866) 834-4311 in the U.S. or (720) 405-2213 internationally (conference passcode number: 3589374). The live audio webcast and presentation slides will be available at http://investors.coty.com. The conference call will be available for replay.

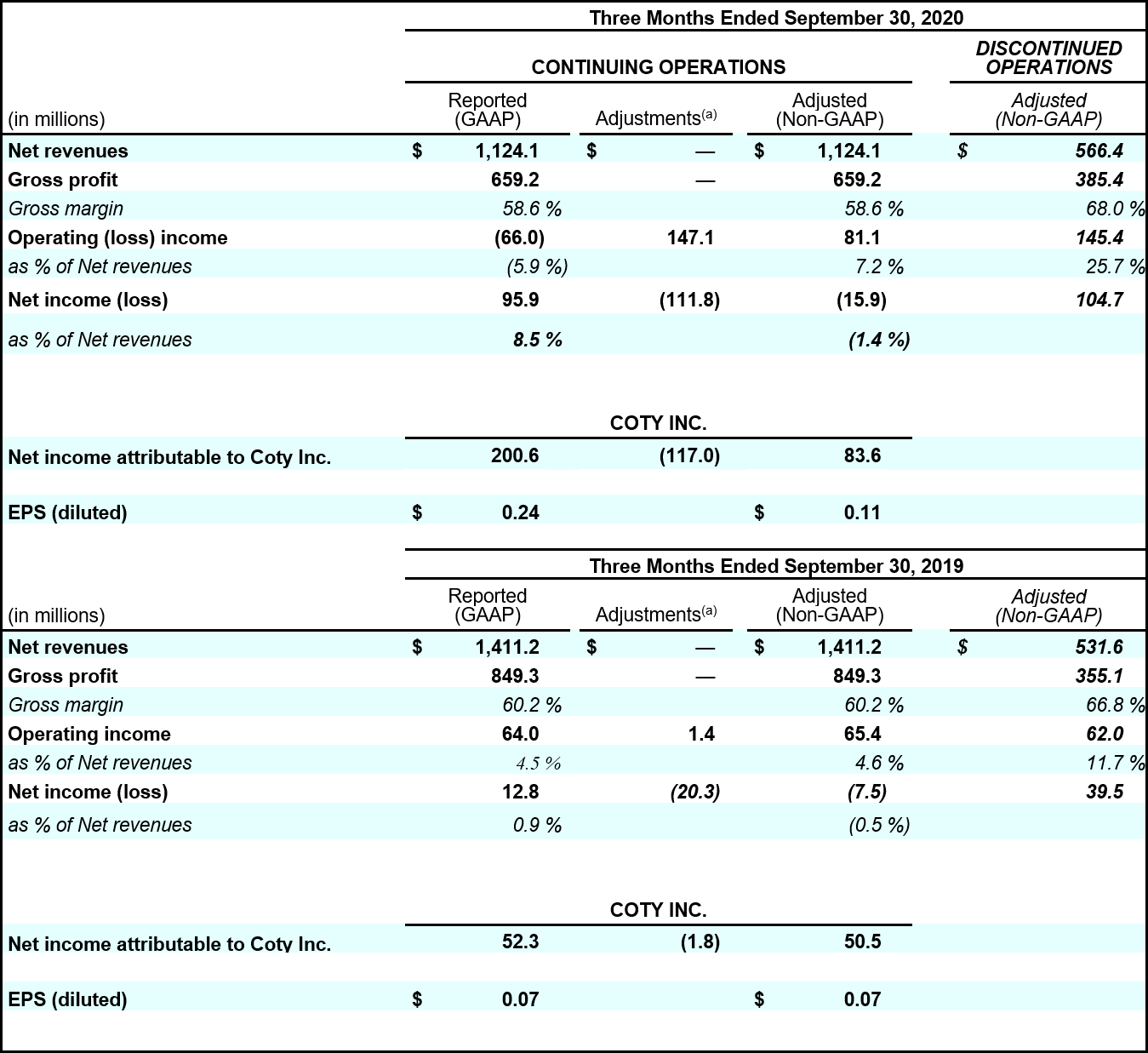

COTY INC. SUPPLEMENTAL SCHEDULES INCLUDING NON-GAAP FINANCIAL MEASURES

RESULTS AT A GLANCE

* These measures, as well as “free cash flow,” “adjusted earnings before interest, taxes, depreciation and amortization (EBITDA),” "immediate liquidity," “financial net debt,” and "economic net debt" are Non-GAAP Financial Measures. Refer to “Non-GAAP Financial Measures” for discussion of these measures. Net income (loss) represents Net income (loss) Attributable to Coty Inc. Reconciliations from reported to adjusted results can be found at the end of this release.

** Net income (loss) for Continuing Operations and Coty Inc. are net of the Convertible Series B Preferred Stock dividends.

*** Coty Inc Net revenues, Operating income (loss) -reported and Operating income (loss) -Adjusted, shows the combined activities of the total Coty Inc. to allow investors to compare to our prior financial results.

FIRST QUARTER BY SEGMENT (CONTINUING OPERATIONS)

Americas

EMEA

Asia Pacific

FIRST QUARTER FISCAL 2021 BY CHANNEL

Continuing Operations

Discontinued Operations

COTY INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(a) Diluted EPS is adjusted by the effect of dilutive securities, including awards under our equity compensation plans and the convertible Series B Preferred Stock. We use the if-converted method for calculating any potential dilutive effect of the convertible Series B Preferred Stock, which requires an adjustment to reverse the impact of the preferred stock dividends of $20.8 on income applicable to common stockholders during the period.

RECONCILIATION OF REPORTED TO ADJUSTED RESULTS FOR THE CONSOLIDATED STATEMENTS OF OPERATIONS

These supplemental schedules provide adjusted Non-GAAP financial information and a quantitative reconciliation of the difference between the Non-GAAP financial measure and the financial measure calculated and reported in accordance with GAAP.

(a) See “Reconciliation of Reported Operating (Loss) Income to Adjusted Operated Income” and “Reconciliation of Reported Net (Loss) Income to Adjusted Net Income” for a detailed description of adjusted items.

RECONCILIATION OF REPORTED OPERATING (LOSS) INCOME TO ADJUSTED OPERATING INCOME

(a) In the three months ended September 30, 2020, amortization expense increased to $65.4 from $58.3 in the three months ended September 30, 2019. In the three months ended September 30, 2020, amortization expense of $26.1, $32.8 and $6.5 was reported in the Americas, EMEA and Asia Pacific segments, respectively. In the three months ended September 30, 2019, amortization expense of $12.7, $31.9, $6.3 and $7.4 was reported in the Americas, EMEA, Asia Pacific and Other segments, respectively.

(b) In the three months ended September 30, 2020, we incurred restructuring and other business structure realignment costs of $35.4. We incurred restructuring costs of $30.1 primarily for charges related to the Transformation Plan, included in the Condensed Consolidated Statements of Operations; and business structure realignment costs of $5.3 primarily related to the Transformation Plan and certain other programs. This amount includes $5.3 reported in selling, general and administrative expenses, primarily related to severance, consulting costs and accelerated depreciation costs and nil reported in cost of sales in the Condensed Consolidated Statement of Operations. In the three months ended September 30, 2019, we incurred business structure realignment costs of $27.6, including restructuring costs of $4.8 primarily for charges related to the Transformation Plan, included in the Condensed Consolidated Statements of Operations. In addition, we incurred business structure realignment costs of $22.8 primarily related to our Global Integration Activities and certain other programs. This amount includes $22.8 reported in selling, general and administrative expenses and nil reported in cost of sales in the Condensed Consolidated Statements of Operations, primarily due to costs incurred for the realignment of the business due to the P&G Beauty Business.

(c) In the three months ended September 30, 2020, we incurred acquisition and divestiture related costs of $46.3. These costs were associated with the Wella Transaction. In the three months ended September 30, 2019, we did not incur any acquisition and divestiture related costs.

(d) In the three months ended September 30, 2020, there were no gains on divestitures and sale of brand assets. In the three months ended September 30, 2019, as a result of the divestiture of Younique, we recorded income of $84.5 included in gain on divestitures and sale of brand assets included in the Condensed Consolidated Statements of Operations.

RECONCILIATION OF REPORTED OPERATING INCOME TO ADJUSTED OPERATING INCOME

(a) In the three months ended September 30, 2020, amortization expense decreased to $65.4 from $84.3 in the three months ended September 30, 2019. In the three months ended September 30, 2020, amortization expense of $26.1, $32.8 and $6.5 was reported in the Americas, EMEA and Asia Pacific segments, respectively. In the three months ended September 30, 2019, amortization expense of $12.7, $31.9, $6.3, $7.4, and $26.0 was reported in the Americas, EMEA, Asia Pacific and Other segments and discontinued operations, respectively.

(b) In the three months ended September 30, 2020, we incurred restructuring and other business structure realignment costs of $35.4. We incurred restructuring costs of $30.1 primarily for charges related to the Transformation Plan, included in the Condensed Consolidated Statements of Operations; and business structure realignment costs of $5.3 primarily related to the Transformation Plan and certain other programs. This amount includes $5.3 reported in selling, general and administrative expenses, primarily related to severance, consulting costs and accelerated depreciation costs and nil reported in cost of sales in the Condensed Consolidated Statement of Operations. In the three months ended September 30, 2019, we incurred business structure realignment costs of $27.6, including restructuring costs of $4.8 primarily for charges related to the Transformation Plan, included in the Condensed Consolidated Statements of Operations. In addition, we incurred business structure realignment costs of $22.8 primarily related to our Global Integration Activities and certain other programs. This amount includes $22.8 reported in selling, general and administrative expenses and nil reported in cost of sales in the Condensed Consolidated Statements of Operations, primarily due to costs incurred for the realignment of the business due to the P&G Beauty Business.

(c) In the three months ended September 30, 2020, we incurred acquisition and divestiture related costs of $46.3. These costs were associated with the Wella Transaction. In the three months ended September 30, 2019, we did not incur any acquisition and divestiture related costs.

(d) In the three months ended September 30, 2020, there were no gains on divestitures and sale of brand assets. In the three months ended September 30, 2019, as a result of the divestiture of Younique, we recorded income of $84.5 included in gain on divestitures and sale of brand assets included in the Condensed Consolidated Statements of Operations.

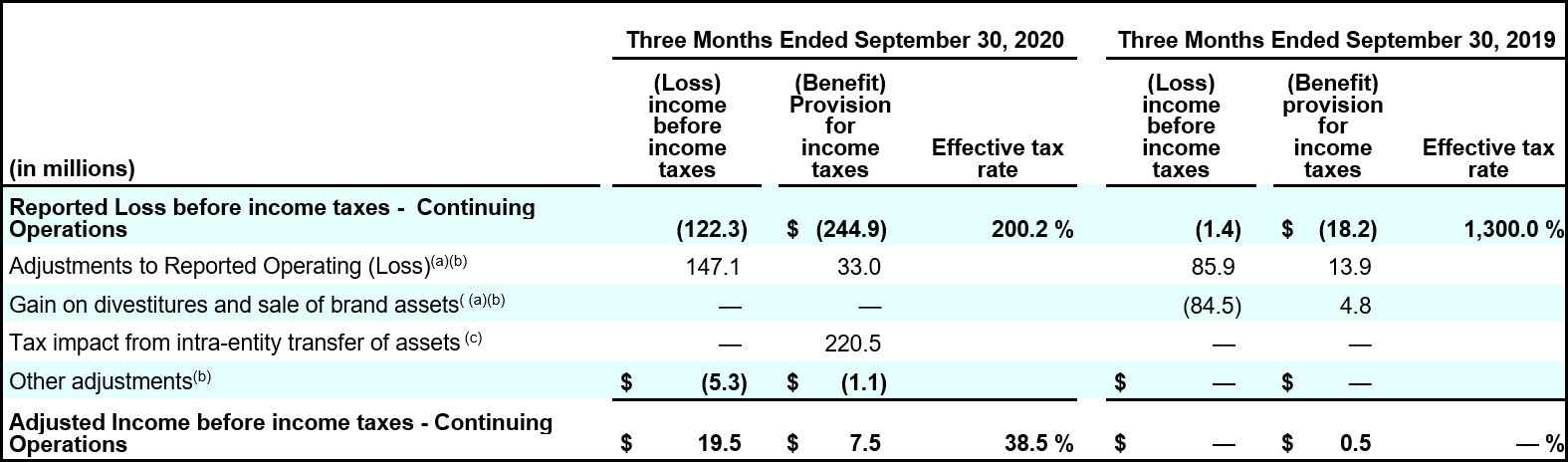

RECONCILIATION OF REPORTED (LOSS) INCOME BEFORE INCOME TAXES AND EFFECTIVE TAX RATES TO ADJUSTED INCOME BEFORE INCOME TAXES AND ADJUSTED EFFECTIVE TAX RATES FOR CONTINUING OPERATIONS

The adjusted effective tax rate was 38.5% for the three months ended September 30, 2020 compared to 0.0% for the three months ended September 30, 2019. The difference was primarily due to the jurisdictional mix of income.

See a description on adjustments under “Reconciliation of Reported Operating (Loss) Income to Adjusted Operating (Loss) Income”.

(a) See a description of adjustments under “Adjusted Operating (Loss) Income for Coty Inc.”

(b) The tax effects of each of the items included in adjusted income are calculated in a manner that results in a corresponding income tax expense/provision for adjusted income. In preparing the calculation, each adjustment to reported income is first analyzed to determine if the adjustment has an income tax consequence. The provision for taxes is then calculated based on the jurisdiction in which the adjusted items are incurred, multiplied by the respective statutory rates and offset by the increase or reversal of any valuation allowances commensurate with the non-GAAP measure of profitability.

(c) Tax benefit of $220.5 is the result of a tax rate differential on the deferred taxes recognized on the transfer of assets and liabilities, following the relocation of our main principal location from Geneva to Amsterdam. This amount will be finalized when negotiations with the tax authorities are completed.

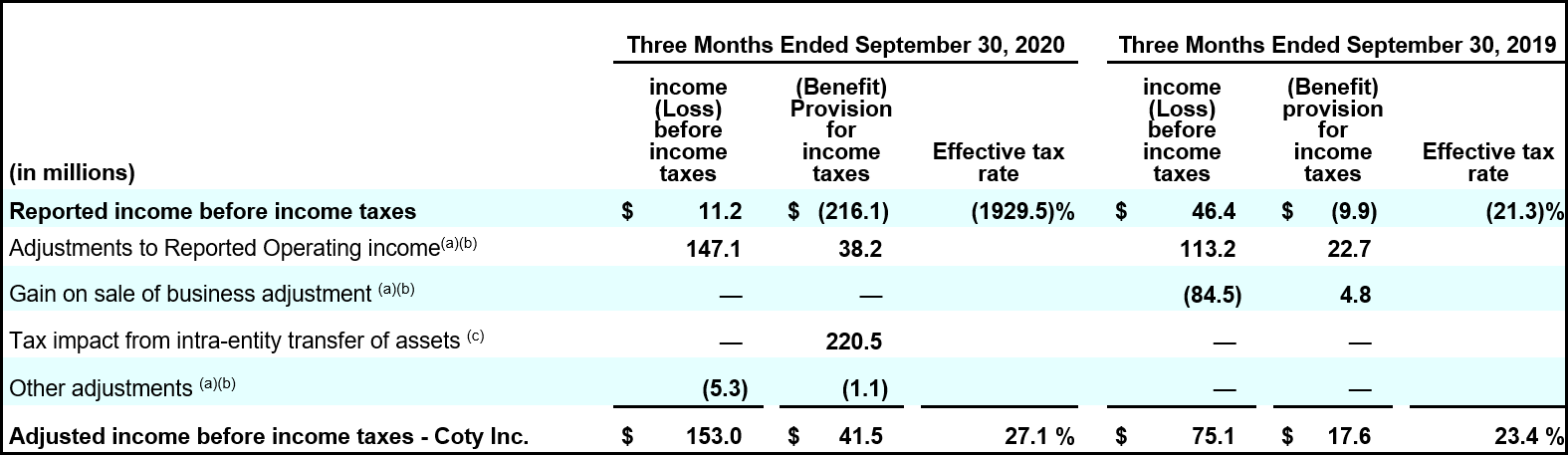

RECONCILIATION OF REPORTED INCOME BEFORE INCOME TAXES AND EFFECTIVE TAX RATES TO ADJUSTED INCOME BEFORE INCOME TAXES AND ADJUSTED EFFECTIVE TAX RATES FOR COTY INC.

The adjusted effective tax rate was 27.1% for the three months ended September 30, 2020 compared to 23.4% for the three months ended September 30, 2019. The difference was primarily due to the jurisdictional mix of income.

(a) See a description of adjustments under “Adjusted Operating (Loss) Income for Coty Inc.”

(b) The tax effects of each of the items included in adjusted income are calculated in a manner that results in a corresponding income tax expense/provision for adjusted income. In preparing the calculation, each adjustment to reported income is first analyzed to determine if the adjustment has an income tax consequence. The provision for taxes is then calculated based on the jurisdiction in which the adjusted items are incurred, multiplied by the respective statutory rates and offset by the increase or reversal of any valuation allowances commensurate with the non-GAAP measure of profitability.

(c) Tax benefit of $220.5 is the result of a tax rate differential on the deferred taxes recognized on the transfer of assets and liabilities, following the relocation of our main principal location from Geneva to Amsterdam. This amount will be finalized when negotiations with the tax authorities are completed.

RECONCILIATION OF REPORTED NET INCOME TO ADJUSTED NET LOSS FOR CONTINUING OPERATIONS

(a) See a description of adjustments under “Adjusted Operating Income for Continuing Operations.”

(b) The amounts represent the after-tax impact of the non-GAAP adjustments included in Net income attributable to noncontrolling interest based on the relevant noncontrolling interest percentage in the Condensed Consolidated Statements of Operations.

(c) Diluted EPS is adjusted by the effect of dilutive securities, including awards under our equity compensation plans and the convertible Series B Preferred Stock. We use the if-converted method for calculating any potential dilutive effect of the convertible Series B Preferred Stock, which requires an adjustment to reverse the impact of the preferred stock dividends of $20.8 on income applicable to common stockholders during the period.

RECONCILIATION OF REPORTED NET INCOME TO ADJUSTED NET INCOME FOR COTY INC.

(a) See a description of adjustments under “Adjusted Operating Income for Coty Inc..”

(b) The amounts represent the after-tax impact of the non-GAAP adjustments included in Net income attributable to noncontrolling interest based on the relevant noncontrolling interest percentage in the Condensed Consolidated Statements of Operations.

(c) Diluted EPS is adjusted by the effect of dilutive securities, including awards under our equity compensation plans and the convertible Series B Preferred Stock. We use the if-converted method for calculating any potential dilutive effect of the convertible Series B Preferred Stock, which requires an adjustment to reverse the impact of the preferred stock dividends of $20.8 on income applicable to common stockholders during the period.

RECONCILIATION OF NET CASH ROVIDED BY OPERATING ACTIVITIES TO FREE CASH FLOW

RECONCILIATION OF TOTAL DEBT TO FINANCIAL NET DEBT

RECONCILIATION OF TOTAL DEBT TO ECONOMIC NET DEBT

IMMEDIATE LIQUIDITY

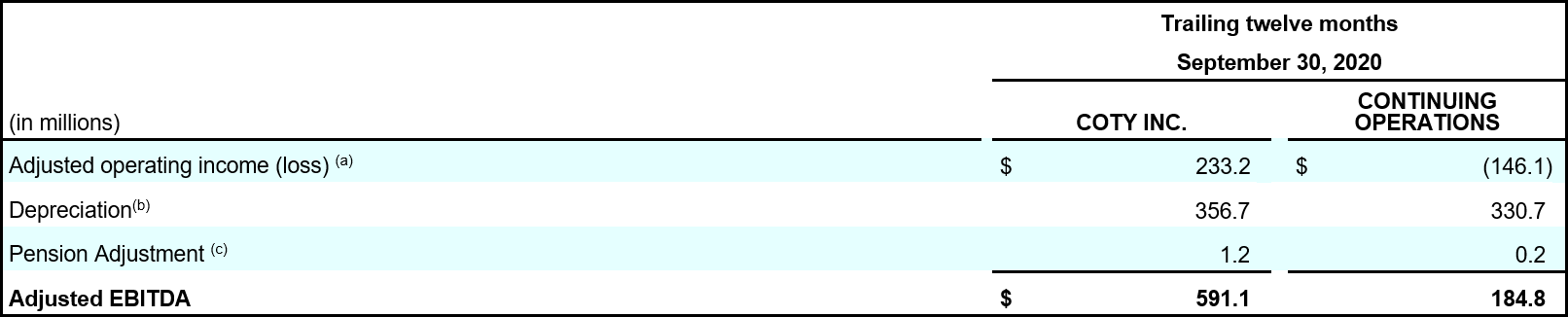

RECONCILIATION OF ADJUSTED OPERATING INCOME (LOSS) TO ADJUSTED EBITDA

a. Adjusted operating income for the twelve months ended September 30, 2020 represents the summation of the adjusted operating income for each of the three months ended December 31, 2019, March 31, 2020, June 30, 2020 and September 30, 2020. For a reconciliation of adjusted operating income to operating income for each of those periods, see the tables entitled “Reconciliation of Reported Operating Income to Adjusted Operating Income” and "Reconciliation of Reported Operating Income to Adjusted Operating Income by Segment" for each of those periods.

b. The depreciation adjustment for Coty Inc. for the twelve months ended September 30, 2020 represents the summation of depreciation expense for each of the three months ended December 31, 2019, March 31, 2020, June 30, 2020 and September 30, 2020, as adjusted by $0.0, $0.3, $9.1 and $7.8 respectively, for accelerated depreciation.

c. The pension expense adjustment for the twelve months ended September 30, 2020 represents the summation of the non-service cost components of net periodic pension cost for each of the three months ended December 31, 2019, March 31, 2020, June 30, 2020 and September 30, 2020.

FINANCIAL NET DEBT/ADJUSTED EBITDA

NET REVENUES AND ADJUSTED OPERATING (LOSS) INCOME FROM CONTINUING OPERATIONS BY SEGMENT

RECONCILIATION OF REPORTED OPERATING (LOSS) INCOME TO ADJUSTED OPERATING INCOME (LOSS) BY SEGMENT - CONTINUING OPERATIONS

(a) See “Reconciliation of Reported Operating Loss to Adjusted Operated (Loss) Income” for a detailed description of adjusted items.

RECONCILIATION OF REPORTED NET REVENUES TO LIKE-FOR-LIKE NET REVENUES

¹ Like for Like impact reflects the net revenue contribution from King Kylie, net of the decreased net revenues from the divestiture of Younique.

COTY INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

COTY INC. & SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

COTY INC. & SUBSIDIARIES

DISCONTINUED OPERATIONS

About Coty Inc.

Coty is one of the world’s largest beauty companies with an iconic portfolio of brands across fragrance, color cosmetics, and skin and body care. Coty is the global leader in fragrance, and number three in color cosmetics. Coty’s products are sold in over 150 countries around the world. Coty and its brands are committed to a range of social causes as well as seeking to minimize its impact on the environment. For additional information about Coty Inc., please visit www.coty.com.

Forward Looking Statements

Certain statements in this Earnings Release are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect the Company's current views with respect to, among other things, the impact of COVID-19 and potential recovery scenarios, the Company’s comprehensive transformation agenda (the "Transformation Plan"), strategic planning, targets, segment reporting and outlook for future reporting periods (including the extent and timing of revenue, expense and profit trends and changes in operating cash flows and cash flows from operating activities and investing activities), the sale of the Professional and Retail Hair business, including the Wella, Clairol, OPI and ghd brands (the “Wella Business”) and the investment by Rainbow UK Bidco Limited ((“KKR Bidco”) an affiliate of funds and/or separately managed accounts advised and/or managed by Kohlberg Kravis Roberts & Co. L.P. and its affiliates (collectively, "KKR")) in connection with the standalone business (the “Wella Transaction”), including timing of the Wella Transaction and the use of proceeds from the Wella Transaction, the Company’s future operations and strategy (including the expected implementation and related impact of its strategic priorities), ongoing and future cost efficiency and restructuring initiatives and programs, strategic transactions (including their expected timing and impact), the Company’s capital allocation strategy and payment of dividends (including suspension of dividend payments and the duration thereof), investments, licenses and portfolio changes, synergies, savings, performance, cost, timing and integration of acquisitions, including the strategic partnership with Kylie Jenner and the announced pending transaction with Kim Kardashian West, future cash flows, liquidity and borrowing capacity, timing and size of cash outflows and debt deleveraging, the availability of local government funding or reimbursement programs in connection with COVID-19 (including expected timing and amounts), the timing and extent of any future impairments, and synergies, savings, impact, cost, timing and implementation of the Company’s Transformation Plan, including operational and organizational structure changes, operational execution and simplification initiatives, fixed cost reductions, supply chain changes, e-commerce and digital initiatives, and the priorities of senior management. These forward-looking statements are generally identified by words or phrases, such as “anticipate”, “are going to”, “estimate”, “plan”, “project”, “expect”, “believe”, “intend”, “foresee”, “forecast”, “will”, “may”, “should”, “outlook”, “continue”, “temporary”, “target”, “aim”, “potential”, “goal” and similar words or phrases. These statements are based on certain assumptions and estimates that we consider reasonable, but are subject to a number of risks and uncertainties, many of which are beyond our control, which could cause actual events or results (including our financial condition, results of operations, cash flows and prospects) to differ materially from such statements, including risks and uncertainties relating to:

- the impact of COVID-19 (or future similar events), including demand for the Company’s products, illness, quarantines, government actions, facility closures, store closures or other restrictions in connection with the COVID-19 pandemic, and the extent and duration thereof, related impact on the Company's ability to meet customer needs and on the ability of third parties on which the Company relies, including its suppliers, customers, contract manufacturers, distributors, contractors, commercial banks and joint-venture partners, to meet their obligations to the Company, in particular collections from customers, the extent that government funding and reimbursement programs in connection with COVID-19 are available to the Company, and the ability to successfully implement measures to respond to such impacts;

- the Company’s ability to successfully implement its multi-year Transformation Plan, including its management realignment, reporting structure changes, operational and organizational changes, and the initiatives to further reduce the Company's cost base, and to develop and achieve its global business strategies (including mix management, select price increases, more disciplined promotions, and foregoing low value sales), compete effectively in the beauty industry, achieve the benefits contemplated by its strategic initiatives (including revenue growth, cost control, gross margin growth and debt deleveraging) and successfully implement its strategic priorities (including innovation performance in prestige and mass channels, strengthening its positions in core markets, accelerating its digital and e-commerce capabilities, building on its skincare portfolio, and expanding its presence in China) in each case within the expected time frame or at all;

- the timing, costs and impacts of the Wella Transaction or other divestitures, and the amount and use of proceeds from any such transactions;

- the Company's ability to successfully implement the separation of the Wella Business;

- the Company’s ability to anticipate, gauge and respond to market trends and consumer preferences, which may change rapidly, and the market acceptance of new products, including new products related to Kylie Jenner’s existing beauty business, any relaunched or rebranded products and the anticipated costs and discounting associated with such relaunches and rebrands, and consumer receptiveness to our current and future marketing philosophy and consumer engagement activities (including digital marketing and media);

- use of estimates and assumptions in preparing the Company’s financial statements, including with regard to revenue recognition, income taxes (including the expected timing and amount of the release of any tax valuation allowance), the assessment of goodwill, other intangible and long-lived assets for impairments, the market value of inventory, and the fair value of acquired assets and liabilities associated with acquisitions;

- the impact of any future impairments;

- managerial, transformational, operational, regulatory, legal and financial risks, including diversion of management attention to and management of cash flows, expenses and costs associated with the Company's response to COVID-19, the Transformation Plan, the Wella Transaction and related transition services, the integration of the King Kylie Transaction, and future strategic initiatives, and, in particular, the Company's ability to manage and execute many initiatives simultaneously including any resulting complexity, employee attrition or diversion of resources;

- future divestitures and the impact thereof on, and future acquisitions (including the pending transaction with Kim Kardashian West), new licenses and joint ventures and the integration thereof with, our business, operations, systems, financial data and culture and the ability to realize synergies, avoid future supply chain and other business disruptions, reduce costs (including through the Company's cash efficiency initiatives), avoid liabilities and realize potential efficiencies and benefits (including through our restructuring initiatives) at the levels and at the costs and within the time frames contemplated or at all;

- increased competition, consolidation among retailers, shifts in consumers’ preferred distribution and marketing channels (including to digital and prestige channels), distribution and shelf-space resets or reductions, compression of go-to-market cycles, changes in product and marketing requirements by retailers, reductions in retailer inventory levels and order lead-times or changes in purchasing patterns, impact from COVID-19 on retail revenues, and other changes in the retail, e-commerce and wholesale environment in which the Company does business and sells its products and the Company’s ability to respond to such changes (including its ability to expand its digital, direct-to-consumer and e-commerce capabilities within contemplated timeframes or at all);

- the Company and its joint ventures’, business partners’ and licensors’ abilities to obtain, maintain and protect the intellectual property used in its and their respective businesses, protect its and their respective reputations (including those of its and their executives or influencers), public goodwill, and defend claims by third parties for infringement of intellectual property rights;

- any change to the Company’s capital allocation and/or cash management priorities, including any change in the Company’s dividend policy or, if the Company's Board declares dividends, the Company's stock dividend reinvestment program;

- any unanticipated problems, liabilities or integration or other challenges associated with a past or future acquired business, joint ventures or strategic partnerships which could result in increased risk or new, unanticipated or unknown liabilities, including with respect to environmental, competition and other regulatory, compliance or legal matters;

- the Company’s international operations and joint ventures, including enforceability and effectiveness of its joint venture agreements and reputational, compliance, regulatory, economic and foreign political risks, including difficulties and costs associated with maintaining compliance with a broad variety of complex local and international regulations;

- the Company's dependence on certain licenses (especially in the fragrance category) and the Company's ability to renew expiring licenses on favorable terms or at all;

- the Company's dependence on entities performing outsourced functions, including outsourcing of distribution functions, and third-party manufacturers, logistics and supply chain suppliers, and other suppliers, including third-party software providers, web-hosting and e-commerce providers;

- administrative, product development and other difficulties in meeting the expected timing of market expansions, product launches and marketing efforts;

- global political and/or economic uncertainties, disruptions or major regulatory or policy changes, and/or the enforcement thereof that affect the Company’s business, financial performance, operations or products, including the impact of Brexit (and business or market disruption arising from a "hard Brexit"), the current U.S. administration and upcoming election, changes in the U.S. tax code, and recent changes and future changes in tariffs, retaliatory or trade protection measures, trade policies and other international trade regulations in the U.S., the European Union and Asia and in other regions where the Company operates;

- currency exchange rate volatility and currency devaluation;

- the number, type, outcomes (by judgment, order or settlement) and costs of current or future legal, compliance, tax, regulatory or administrative proceedings, investigations and/or litigation, including litigation relating to the tender offer by Cottage Holdco B.V. (the “Cottage Tender Offer”)and product liability cases (including asbestos);

- the Company’s ability to manage seasonal factors and other variability and to anticipate future business trends and needs;

- disruptions in operations, sales and in other areas, including due to disruptions in our supply chain, restructurings and other business alignment activities, the Wella Transaction and related carve-out and transition activities, manufacturing or information technology systems, labor disputes, extreme weather and natural disasters, impact from COVID-19 or similar global public health events, and the impact of such disruptions on the Company’s ability to generate profits, stabilize or grow revenues or cash flows, comply with its contractual obligations and accurately forecast demand and supply needs and/or future results;

- restrictions imposed on the Company through its license agreements, credit facilities and senior unsecured bonds or other material contracts, its ability to generate cash flow to repay, refinance or recapitalize debt and otherwise comply with its debt instruments, and changes in the manner in which the Company finances its debt and future capital needs;

- increasing dependency on information technology, including as a result of remote working in response to COVID-19, and the Company’s ability to protect against service interruptions, data corruption, cyber-based attacks or network security breaches, including ransomware attacks, costs and timing of implementation and effectiveness of any upgrades or other changes to information technology systems, and the cost of compliance or the Company’s failure to comply with any privacy or data security laws (including the European Union General Data Protection Regulation, the California Consumer Privacy Act and the Brazil General Data Protection Law) or to protect against theft of customer, employee and corporate sensitive information;

- the Company's ability to attract and retain key personnel and the impact of senior management transitions and organizational structure changes;

- the distribution and sale by third parties of counterfeit and/or gray market versions of the Company’s products;

- the impact of the Transformation Plan as well as the Wella Transaction on the Company’s relationships with key customers and suppliers and certain material contracts;

- the Company’s relationship with Cottage Holdco B.V., as the Company’s majority stockholder, and its affiliates, and any related conflicts of interest or litigation;

- the Company’s relationship with KKR, whose affiliates KKR Rainbow Aggregator L.P. and KKR Bidco are respectively a significant stockholder in Coty and an investor in the Wella Business, and any related conflicts of interest or litigation;

- future sales of a significant number of shares by the Company’s majority stockholder or the perception that such sales could occur; and

- other factors described elsewhere in this document and in documents that the Company files with the SEC from time to time.

When used herein, the term “includes” and “including” means, unless the context otherwise indicates, “including without limitation”. More information about potential risks and uncertainties that could affect the Company’s business and financial results is included under the heading “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s Quarterly Report on Form 10-K for the year ended June 30, 2020 and other periodic reports the Company has filed and may file with the SEC from time to time.

All forward-looking statements made in this release are qualified by these cautionary statements. These forward-looking statements are made only as of the date of this release, and the Company does not undertake any obligation, other than as may be required by applicable law, to update or revise any forward-looking or cautionary statements to reflect changes in assumptions, the occurrence of events, unanticipated or otherwise, or changes in future operating results over time or otherwise.

Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance unless expressed as such, and should only be viewed as historical data.

Non-GAAP Financial Measures

The Company operates on a global basis, with the majority of net revenues generated outside of the U.S. Accordingly, fluctuations in foreign currency exchange rates can affect results of operations. Therefore, to supplement financial results presented in accordance with GAAP, certain financial information is presented excluding the impact of foreign currency exchange translations to provide a framework for assessing how the underlying businesses performed excluding the impact of foreign currency exchange translations (“constant currency”). Constant currency information compares results between periods as if exchange rates had remained constant period-over-period, with the current period’s results calculated at the prior-year period’s rates. The Company calculates constant currency information by translating current and prior-period results for entities reporting in currencies other than U.S. dollars into U.S. dollars using constant foreign currency exchange rates. The constant currency calculations do not adjust for the impact of revaluing specific transactions denominated in a currency that is different to the functional currency of that entity when exchange rates fluctuate. The constant currency information presented may not be comparable to similarly titled measures reported by other companies. The Company discloses the following constant currency financial measures: net revenues, organic like-for-like (LFL) net revenues, adjusted gross profit and adjusted operating income.

The Company presents period-over-period comparisons of net revenues on a constant currency basis as well as on an organic (LFL) basis. The Company believes that organic (LFL) better enables management and investors to analyze and compare the Company's net revenues performance from period to period. For the periods described in this release, the term “like-for-like” describes the Company's core operating performance, excluding the financial impact of (i) acquired brands or businesses in the current year period until we have twelve months of comparable financial results, (ii) the divested brands or businesses or early terminated brands, generally, in the prior year non-comparable periods, to maintain comparable financial results with the current fiscal year period and (iii) foreign currency exchange translations to the extent applicable. For a reconciliation of organic (LFL) period-over-period, see the table entitled “Reconciliation of Reported Net Revenues to Like-For-Like Net Revenues”.

The Company presents operating income, operating income margin, gross profit, gross margin, effective tax rate, net income, net income margin, net revenues and EPS (diluted) on a non-GAAP basis and specifies that these measures are non-GAAP by using the term “adjusted” (collectively the Adjusted Performance Measures). The reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated and presented in accordance with GAAP are shown in tables below. These non-GAAP financial measures should not be considered in isolation from, or as a substitute for or superior to, financial measures reported in accordance with GAAP. Moreover, these non-GAAP financial measures have limitations in that they do not reflect all the items associated with the operations of the business as determined in accordance with GAAP. Other companies, including companies in the beauty industry, may calculate similarly titled non-GAAP financial measures differently than we do, limiting the usefulness of those measures for comparative purposes.

Adjusted operating income from continuing operations excludes restructuring costs and business structure realignment programs, amortization, acquisition- and divestiture-related costs and acquisition accounting impacts, asset impairment charges and other adjustments as described below. We do not consider these items to be reflective of our core operating performance due to the variability of such items from period-to-period in terms of size, nature and significance. They are primarily incurred to realign our operating structure and integrate new acquisitions, and exclude divestitures, and fluctuate based on specific facts and circumstances. Additionally, Adjusted net income attributable to Coty Inc. and Adjusted net income attributable to Coty Inc. per common share are adjusted for certain interest and other (income) expense as described below and the related tax effects of each of the items used to derive Adjusted net income as such charges are not used by our management in assessing our operating performance period-to-period.

Adjusted Performance Measures reflect adjustments based on the following items:

- Costs related to acquisition and divestiture activities: The Company excludes acquisition- and divestiture-related costs and the accounting impacts such as those related to transaction costs and costs associated with the revaluation of acquired inventory in connection with business combinations because these costs are unique to each transaction. Additionally, for divestitures, the Company excludes write-offs of assets that are no longer recoverable and contract related costs due to the divestiture. The nature and amount of such costs vary significantly based on the size and timing of the acquisitions and divestitures, and the maturities of the businesses being acquired or divested. Also, the size, complexity and/or volume of past transactions, which often drives the magnitude of such expenses, may not be indicative of the size, complexity and/or volume of any future acquisitions or divestitures.

- Restructuring and other business realignment costs: The Company excludes costs associated with restructuring and business structure realignment programs to allow for comparable financial results to historical operations and forward-looking guidance. In addition, the nature and amount of such charges vary significantly based on the size and timing of the programs. By excluding the referenced expenses from the non-GAAP financial measures, management is able to further evaluate the Company’s ability to utilize existing assets and estimate their long-term value. Furthermore, management believes that the adjustment of these items supplement the GAAP information with a measure that can be used to assess the sustainability of the Company’s operating performance.

- Asset impairment charges: The Company excludes the impact of asset impairments as such non-cash amounts are inconsistent in amount and frequency and are significantly impacted by the timing and/or size of acquisitions. Our management believes that the adjustment of these items supplement the GAAP information with a measure that can be used to assess the sustainability of our operating performance.

- Amortization expense: The Company excludes the impact of amortization of finite-lived intangible assets, as such non-cash amounts are inconsistent in amount and frequency and are significantly impacted by the timing and/or size of acquisitions. Management believes that the adjustment of these items supplement the GAAP information with a measure that can be used to assess the sustainability of the Company’s operating performance. Although the Company excludes amortization of intangible assets from the non-GAAP expenses, management believes that it is important for investors to understand that such intangible assets contribute to revenue generation. Amortization of intangible assets that relate to past acquisitions will recur in future periods until such intangible assets have been fully amortized. Any future acquisitions may result in the amortization of additional intangible assets.

- Loss/(Gain) on divestitures and sale of brand assets: The Company excludes the impact of Loss/(gain) on divestitures and sale of brand assets as such amounts are inconsistent in amount and frequency and are significantly impacted by the size of divestitures. Our management believes that the adjustment of these items supplement the GAAP information with a measure that can be used to assess the sustainability of our operating performance.

- Interest (income) expense: The Company excludes foreign currency impacts associated with acquisition-related and debt financing-related forward contracts, as well as debt financing transaction costs as the nature and amount of such charges are not consistent and are significantly impacted by the timing and size of such transactions.

- Other expense: The Company excludes the impact of costs incurred for legal and advisory services rendered in connection with the tender offer that was in fiscal 2019 initiated by certain of our shareholders. Our management believes these costs do not reflect our underlying ongoing business, and the adjustment of such costs helps investors and others compare and analyze performance from period to period. We have also excluded the impact of pension curtailment (gains) and losses and pension settlements as such events are triggered by our restructuring and other business realignment activities and the amount of such charges vary significantly based on the size and timing of the programs.

- Loss on early extinguishment of debt: We have excluded loss on extinguishment of debt as this represents a non-cash charge, and the amount and frequency of such charges is not consistent and is significantly impacted by the timing and size of debt financing transactions.

- Noncontrolling interest: This adjustment represents the after-tax impact of the non-GAAP adjustments included in Net income attributable to noncontrolling interests based on the relevant non-controlling interest percentage.

- Tax: This adjustment represents the impact of the tax effect of the pretax items excluded from Adjusted net income. The tax impact of the non-GAAP adjustments is based on the tax rates related to the jurisdiction in which the adjusted items are received or incurred. Additionally, adjustments are made for the tax impact of any intra-entity transfer of assets and liabilities.

The Company has provided a quantitative reconciliation of the difference between the non-GAAP financial measures and the financial measures calculated and reported in accordance with GAAP. For a reconciliation of adjusted gross profit to gross profit, adjusted EPS (diluted) to EPS (diluted), and adjusted net revenues to net revenues, see the table entitled “Reconciliation of Reported to Adjusted Results for the Consolidated Statements of Operations.” For a reconciliation of adjusted operating income to operating income and adjusted operating income margin to operating income margin, see the tables entitled “Reconciliation of Reported Operating Income (Loss) to Adjusted Operating Income” and "Reconciliation of Reported Operating Income (Loss) to Adjusted Operating Income by Segment." For a reconciliation of adjusted effective tax rate to effective tax rate, see the table entitled “Reconciliation of Reported Income (Loss) Before Income Taxes and Effective Tax Rates to Adjusted Income Before Income Taxes and Adjusted Effective Tax Rates.” For a reconciliation of adjusted net income and adjusted net income margin to net income (loss), see the table entitled “Reconciliation of Reported Net Income (Loss) to Adjusted Net Income.”

The Company also presents free cash flow, adjusted earnings before interest, taxes, depreciation and amortization ("EBITDA"), immediate liquidity, Financial Net Debt and Economic Net Debt. Management believes that these measures are useful for investors because it provides them with an important perspective on the cash available for debt repayment and other strategic measures and provides them with the same measures that management uses as the basis for making resource allocation decisions. Free cash flow is defined as net cash provided by operating activities less capital expenditures; adjusted EBITDA is defined as adjusted operating income less depreciation. Net debt or Financial Net Debt (which the Company referred to as "net debt" in prior reporting periods) is defined as total debt less cash and cash equivalents, and Economic Net Debt is defined as total debt less cash and cash equivalents less the value of the Wella Stake. For a reconciliation of Free Cash Flow, see the table entitled “Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow,” for adjusted EBITDA, see the table entitled “Reconciliation of Adjusted Operating Income to Adjusted EBITDA” and for Financial Net Debt and Economic Net Debt, see the tables entitled “Reconciliation of Total Debt to Financial Net Debt and Economic Net Debt.” Further, our immediate liquidity is defined as the sum of available cash and cash equivalents and available borrowings under our Revolving Credit Facility (please see table "Immediate Liquidity").

These non-GAAP measures should not be considered in isolation, or as a substitute for, or superior to, financial measures calculated in accordance with GAAP.

To the extent that the Company provides guidance, it does so only on a non-GAAP basis and does not provide reconciliations of such forward-looking non-GAAP measures to GAAP due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation, including adjustments that could be made for restructuring, integration and acquisition-related expenses, amortization expenses, adjustments to inventory, and other charges reflected in our reconciliation of historic numbers, the amount of which, based on historical experience, could be significant.

For more information contact :

Investor Relations

Olga Levinzon, +1 212 389-7733

Media

Andra Mielnicki, +1 917 285 0586